Market Outlook

The first half of 2025 ended strongly with Asian Real Estate (RE) Securities rising by 17.53% in USD. A combination of a recovery in REITs and Developers combined with strong FX contribution led to the strong performance. In last month’s outlook, we stated that we remained cautiously optimistic as falling interest rates and inflation were re-igniting interest in the sector. Falling rates in Asia ex-Japan will lead to earnings upgrades as new borrowing costs are in many cases well below average debt costs. Falling rates will also make accretive acquisition possible as borrowing rates fall below cap rates. We cited the Capitaland Ascendas REIT capital raise which benefitted from low funding costs versus cap rates that led to a DPU accretive outcome. The market has vindicated their transaction with the units trading up more than 10% from the placement price at the end of May. The second half of 2025 has already started off positively with an increase of about 2% in the first two days of the quarter. Hong Kong continues to be the standout due to lower rates and improving retail, office and residential fundamentals. Non-farm payrolls for June came in at 147k which was above expectation and the US unemployment rate fell back to 4.1% vs. expectation of increase to 4.3%. As a result of these numbers, the USD rose, and US yields rose. A closer look at the details shows that hiring by public entities and healthcare led to better payroll numbers and the decrease in unemployment rate came from a decrease in labour participation. In fact, the unemployment rate fell most for foreign born employees likely due to forced or self-deportations of migrant workers. Manufacturing jobs declined and private sector hiring was weak. Any weakness in Asian currencies on the back of these better-than-expected numbers is likely to be short lived. The Trump administration also announced on July 3rd that it will be sending letters to trading partners of its new unilateral tariff rates indicating that completing deals by 9th July with all trading partners is unlikely. True to form, it appears now that August 1st is the date of implementation which effectively delays tariffs and allows US importers to build inventories before Christmas and buy time for Trump to try to salvage deals. Overall, we believe the conditions for a weak USD, lower growth, and lower rates in Asia remain intact and see Asian RE securities as a safe harbour benefitting from lower rates and only indirect exposure to trade tensions.

Japan

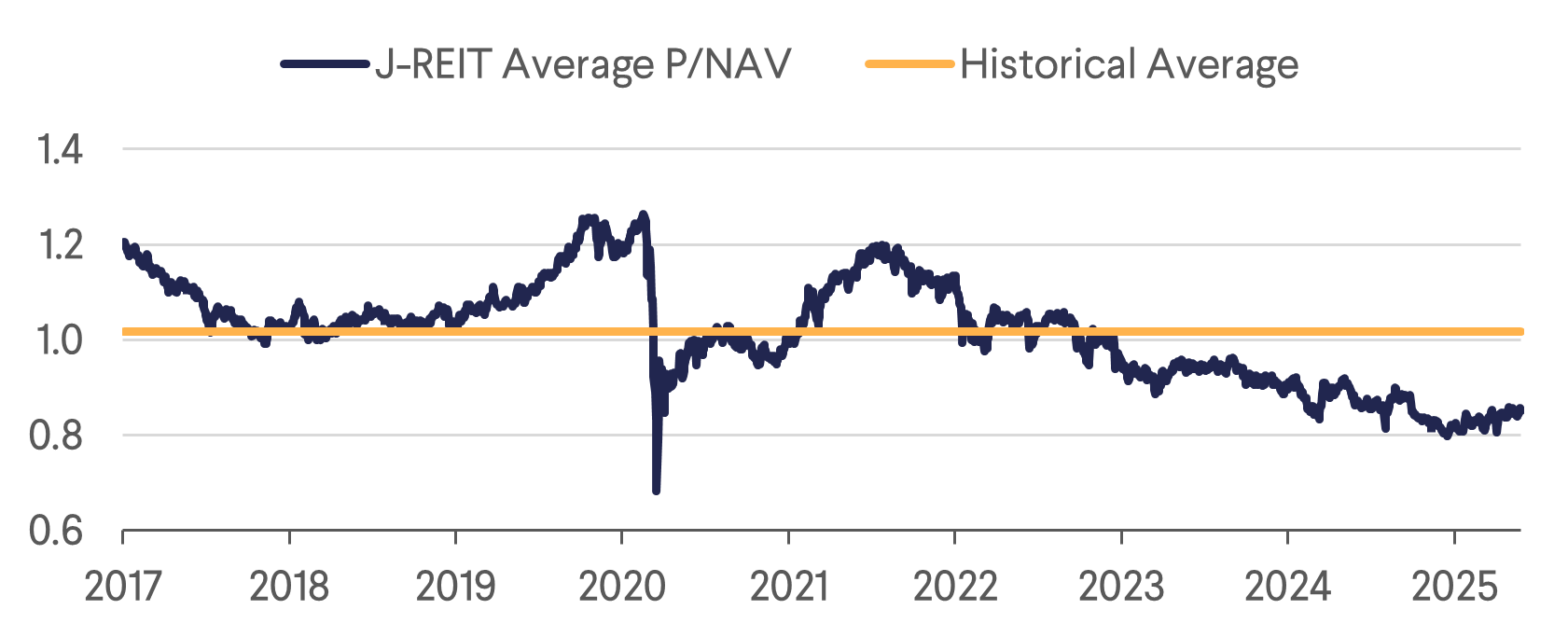

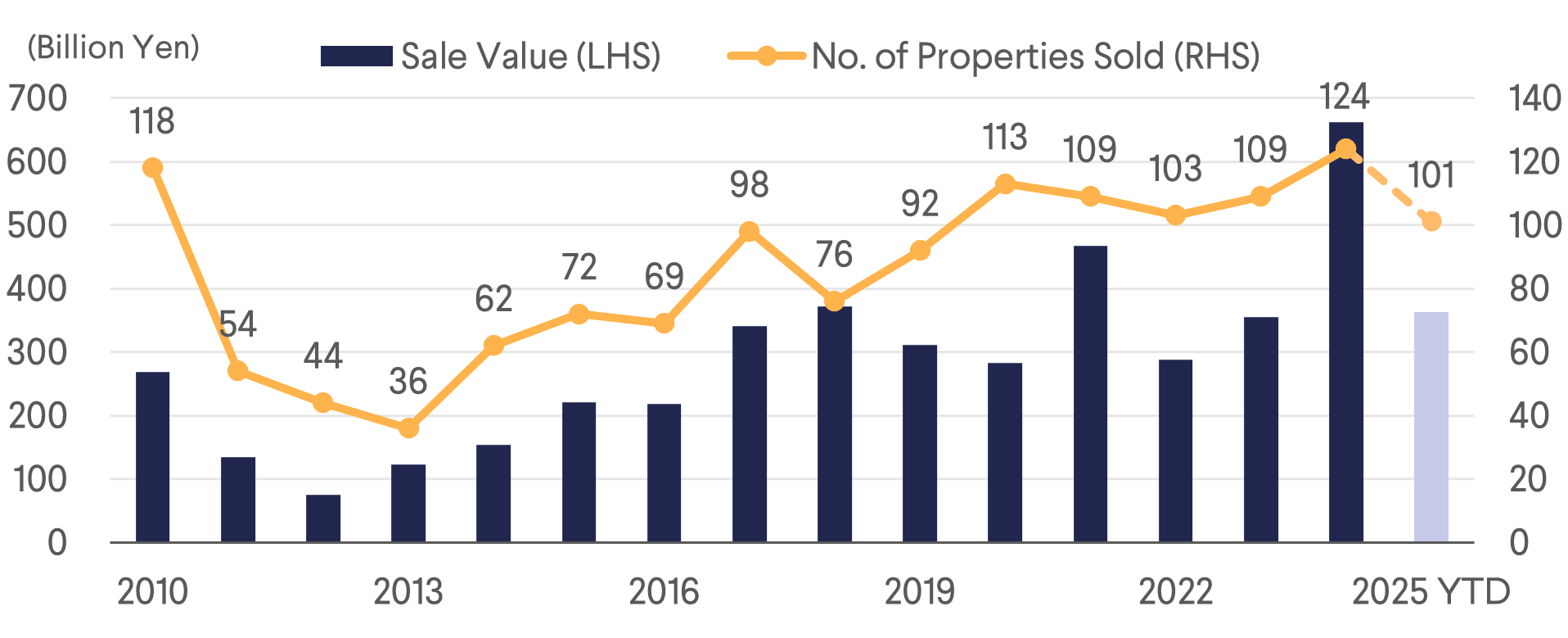

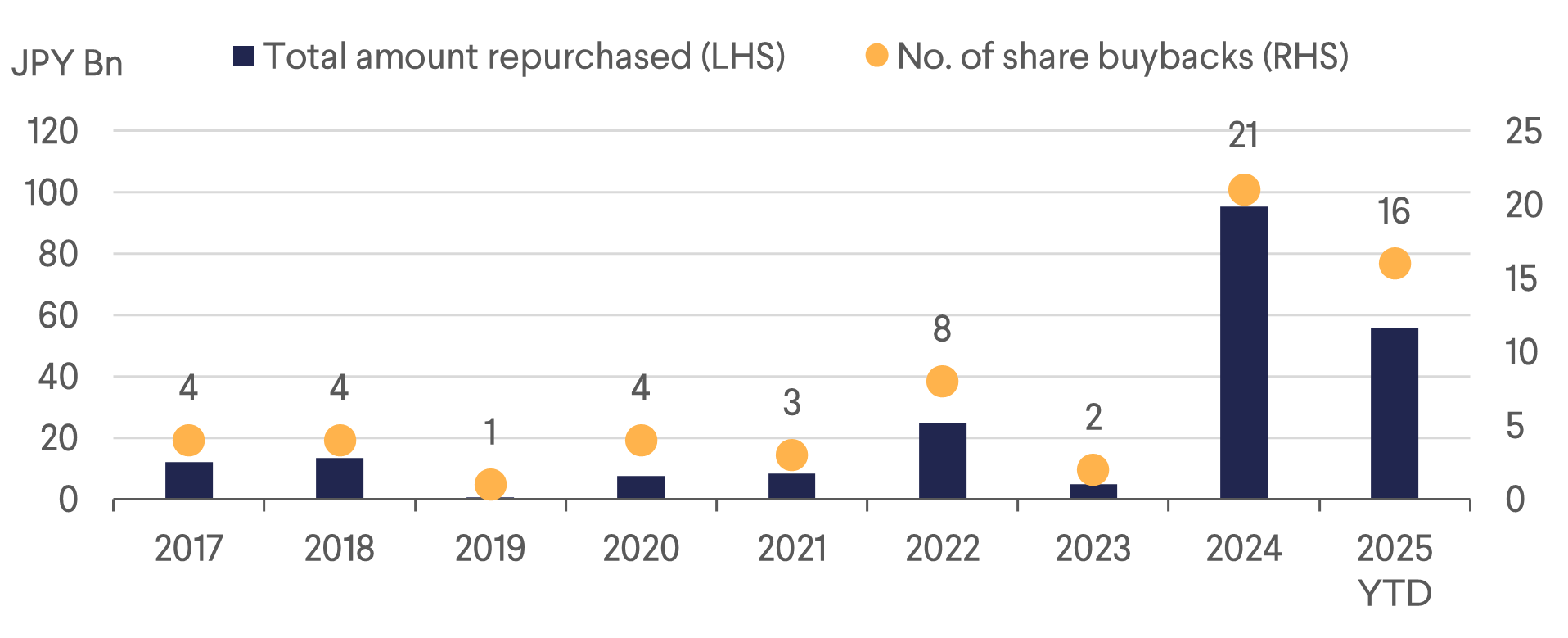

JREITs have been continuing their gradual recovery that started at the end of January (only briefly disrupted during the Trump Tariff Liberation Day sell off) and have risen 11.9% since their January 23 low. JREITs have been actively selling off older assets well above book and appraised values and using net proceeds to fund buybacks. Despite the recovery, JREITs still trade a 13% discount to conservative NAVs.

With ongoing trade tensions between Japan and the Trump administration, the BOJ is unlikely to raise its policy rate until it can assess the impact of tariffs on Japan’s important automobile exports which are likely to remain high based on recent comments coming out of Washington. As we have mentioned previously, we like Developer fundamentals particularly their leasing, leisure, and condominium businesses, but see no near-term catalysts other than potentially more shareholder activism. First quarter results due at end of July and early August will unlikely lead to upward revision for most names and while Tokyo Tatemono and Hulic will report the second quarter at the same time, they may delay asset sales until later in the year so it is unclear if they will revise up substantially in August. One wild card is that both Mitsui Fudosan and Mitsubishi Estate could both announce overseas or domestic asset sales soon to draw attention to their undervalued share prices. We remain very positive on Office and expect to see continuing rent increases in a very tight market. Hotel REITs’ earnings guidance will prove conservative and expect strong results from the sector. There is a chance that the Hotel REITs may seek fresh funds to make acquisitions as they did last summer but we think the offerings will be well supported.

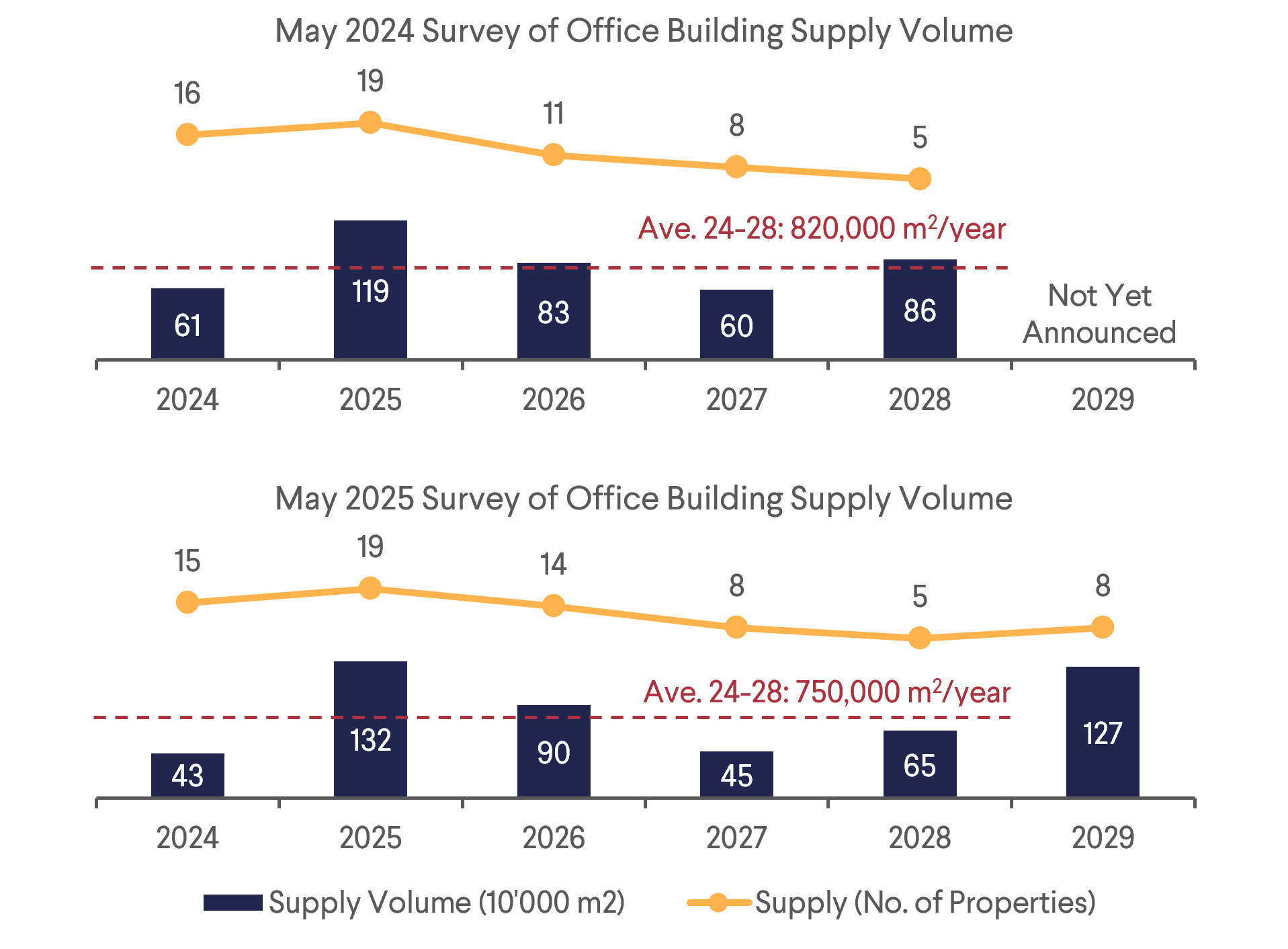

We continue to argue that this cycle for Japan’s real estate market is different than past cycles where supply constraints were absent. Due to construction cost increases which are caused by labour shortages and material price increases, we expect Developers to delay or defer plans to construct large scale projects. Below, this graph shows how expectations for future office construction have shifted. While 2029 looks like a large increase in four years, as we have seen recently some developments are being deferred or delayed. As such, supply in the coming three years appears quite moderate.

Australia

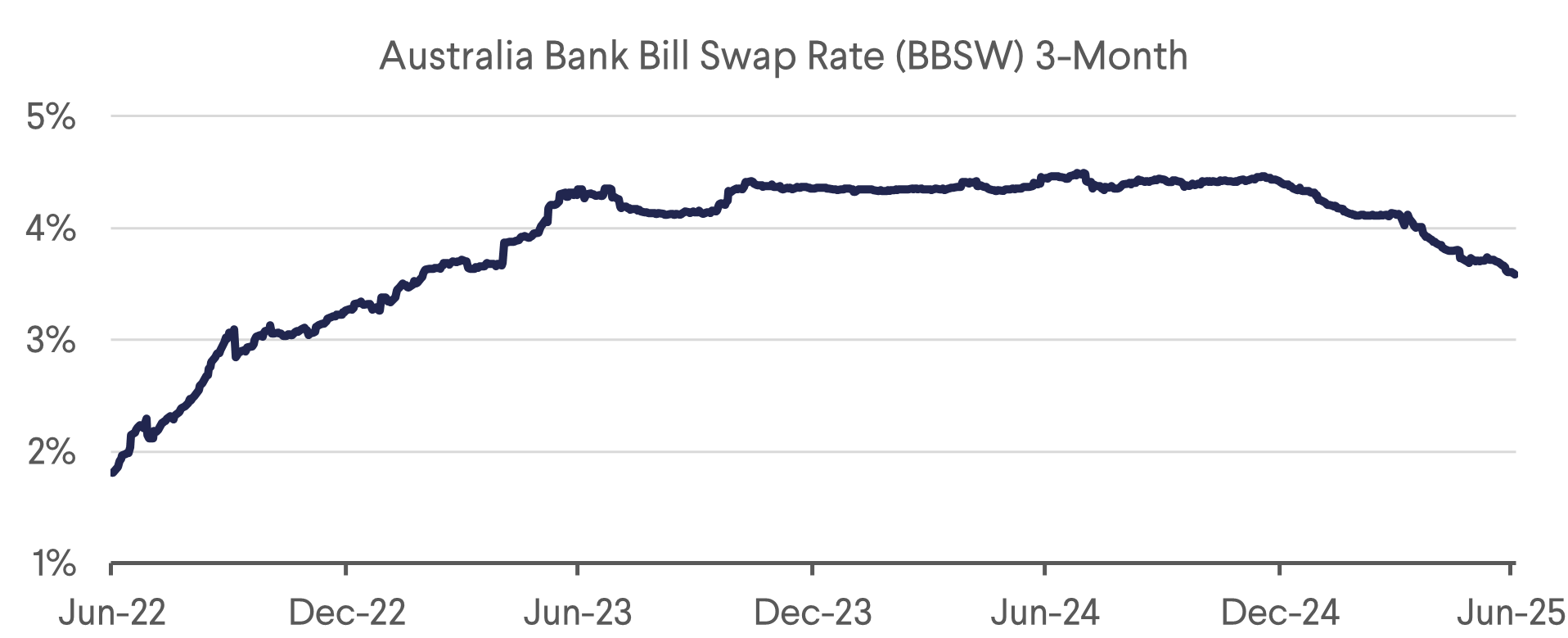

The RBA was expected to cut rates at its July meeting but held rates steady and struck a cautious tone. Nonetheless, we expect cuts later this year. Support for the cuts comes from labor market data that shows a decline in part time jobs, perhaps a lead indicator of slowing labor demand. Overall employment data is still solid. Unemployment has risen from 3.4% to 4.1% which is still a low level but clearly moderating. Economic growth in Q1 was decent, but high frequency measures point to slowing consumer spending and lower confidence. Monthly inflation readings have been inline or below the RBA’s forecast. Trimmed mean inflation came in at 2.4% with headline inflation at 2.1%. Second quarter CPI data will come out on July 30th which will be closely watched after the RBA’s surprise pause at its July meeting. . Overall, it feels that consensus favors interest rate sensitive sectors and we are positioned similarly with overweight on residential related Diversified names like Stockland and Mirvac, Self-Storage, a derivative on housing recovering, a large cap retail, Scentre Group, and fund manager, Charter Hall Group. There is some risk that if the market discounts only two cuts, versus the three implied, that our positioning might struggle short term. However, our selection is based on our positive view for Residential-Diversified, Retail, and Self-Storage due to strong demographic tailwinds rather than just interest rates. AREITs are currently in the quiet period so macro data is more likely to drive share prices until results and guidance are released in August.

Hong Kong

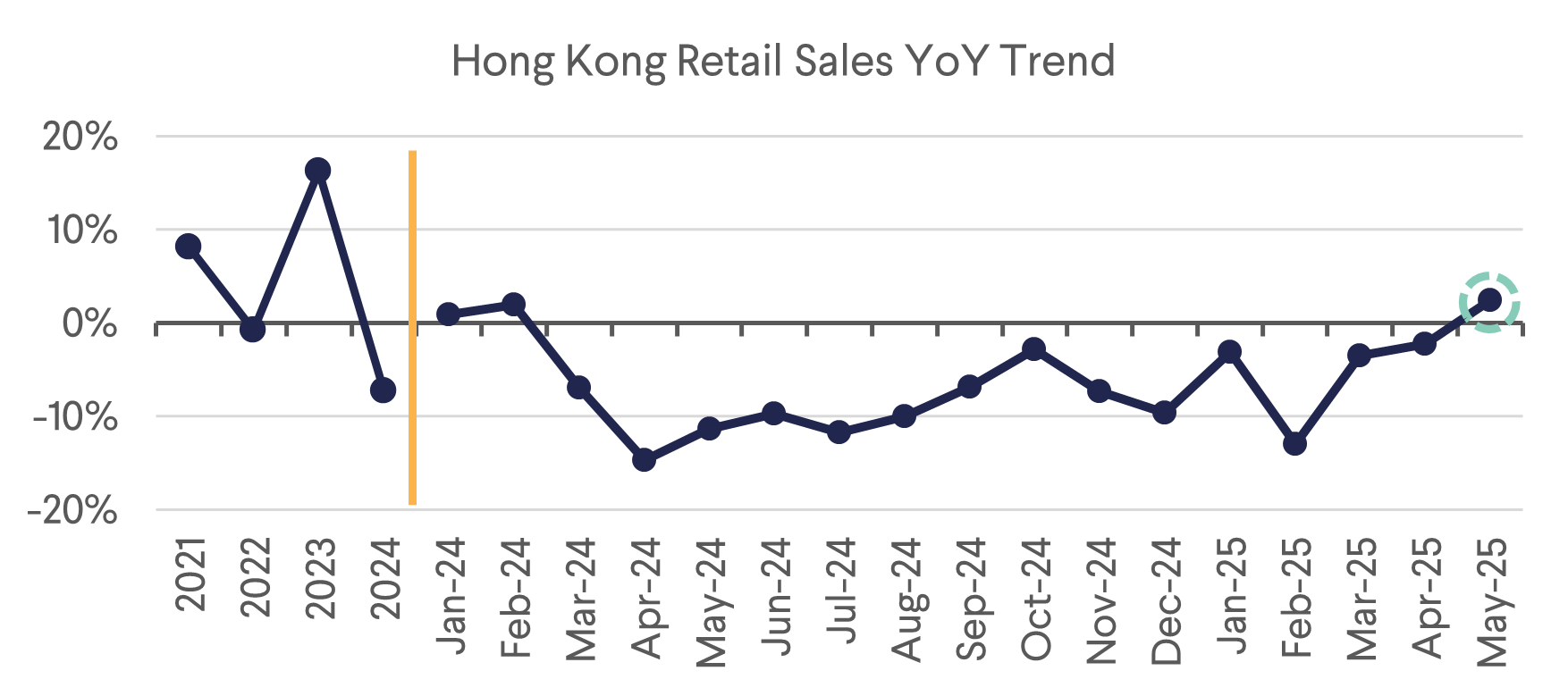

Hong Kong Real Estate securities had a very strong first half of 2025 rising over 20%. Falling HIBOR rates, stabilising retail numbers, improving inbound tourism, recovering residential volumes, and a positive office lease outcome for a new development, combined with investors generally being underweight the sector has helped lift both Developers and REITs. Historically, a weak USD has been a positive for HK property stocks especially if rates are expected to decline. HK’s HIBOR 1m rate currently at around 1.05% (up from a low .524%) is still more than 300 bps below the equivalent USD rate. As we mentioned in past pieces, we do expect the gap between USD and HKD rates to narrow as the HKMA defends the currency at the weak side of the peg. However, we do think HKD rates will remain below equivalent USD rates assuming the USD is weak against other currency pairs. We are positive on retail REITs due to the improving retail trends for non-discretionary segments as leakage to Shenzhen peaks, the potential for HK Stock Connect for REITs, and falling interest costs. HK Land was the standout performer due to its strong commitment to exit development, sell non-core assets, and usage of buybacks and dividends to reduce NAV discount. All large cap Developers trade at near historic discounts to NAV, but we do not expect them to change shareholder return policies and see any recovery in the share prices as cyclical due to improving expectations for a turn in the residential and rental markets rather than re-rating like HKL.

Singapore

Large Cap SREITs have recovered to the top of their trading ranges with Capitaland Integrated Commercial Trust (CICT) and Capitaland Ascendas Trust trading at their 2025 highs. We would not be surprised to see CICT come to the equity market at some point to acquire assets from the sponsor but don’t see a lot of cash calls from existing counters. Despite an overall undervalued SREIT sector, there was one IPO. Given the current valuations, the offering needed to be discounted to find demand. NTT Global Data Center according to its bookrunners had its offering oversubscribed by roughly 2.5x but the overall sentiment regarding the transaction was mixed. The issuer did sweeten its offering by reducing PM fees and waiving acquisition fees. Due to a more realistic expectation on interest costs and the aforementioned fee changes, the initial DPU yield at the low end is expected to come in at 7.5% which is similar to DCREIT’s, and well above Keppel DC REIT’s DPU (low 4% yield). While we are not expecting a strong performance out of the gates for the offering, the sponsor support to underwrite DPU in the first years along with built-in escalations and decent pipeline should lead to above average DPU growth and yield versus most DC focused SREITs. Single tenant exposure in the maiden portfolio is a risk that management believes is measured due to non-break clauses and leases that mature after 2030. They also anticipate future acquisitions to diversify and growth with a large DC in Frankfurt a likely candidate.

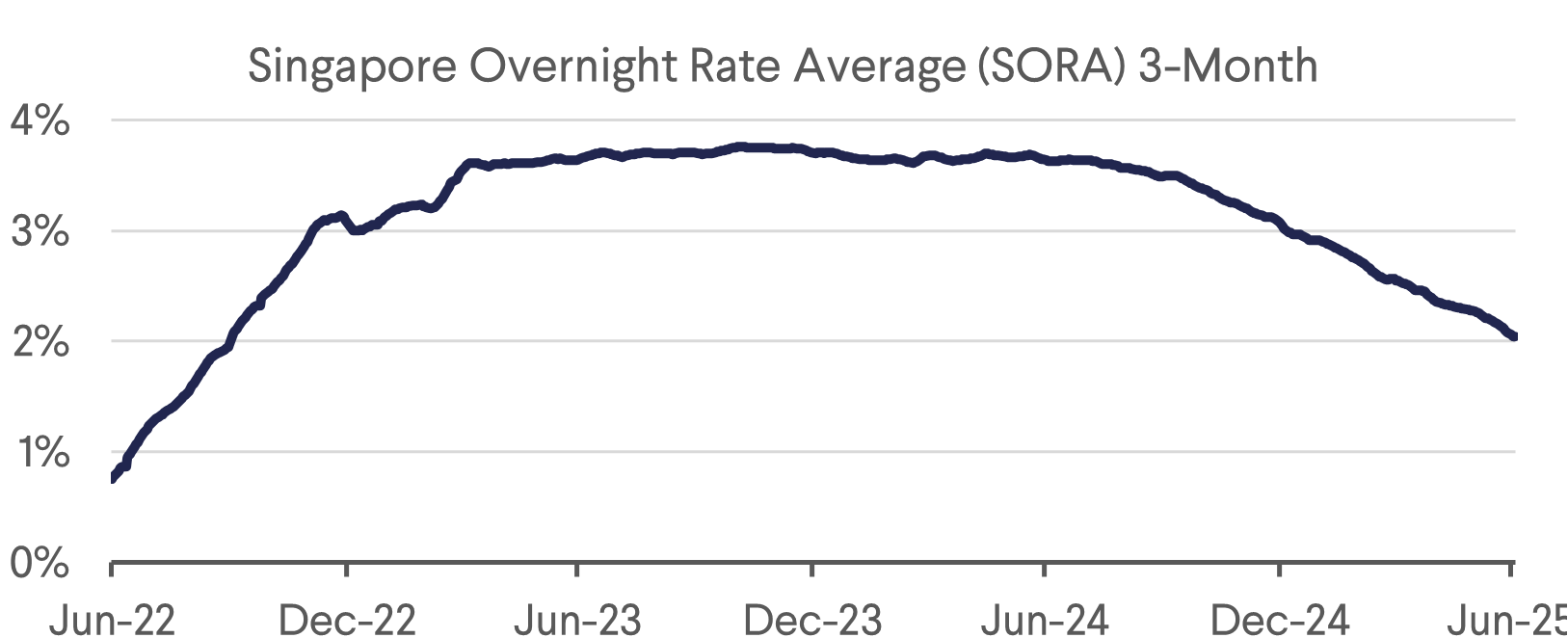

We are bullish on SREITs due to their relative defensiveness and reasonable valuations and will continue to get a strong refinancing tailwind from falling rates in Singapore. 3m SORA continues to drop and this will reduce expenses for SREITs and provide positive carry for SREITs engaging in acquisitions as rates are now below cap rates for many sectors.

Last week, the Singapore government announced additional cooling measures on residential properties. The Seller’s Stamp Duty was raised to 16% for the first year with a 4% annual step down and extended for four years (up from 3 years staring at 12%). The intention here is to curb speculation on new properties that have seen strong take up particularly in the outside of Central Region by local buyers who have increasingly sold on even prior to completion. While this won’t have a dramatic impact, we do think the margin could slow property sales for developers in the near term. We own no Singapore residential developers.

Download the PDF version of the report here