Market Outlook

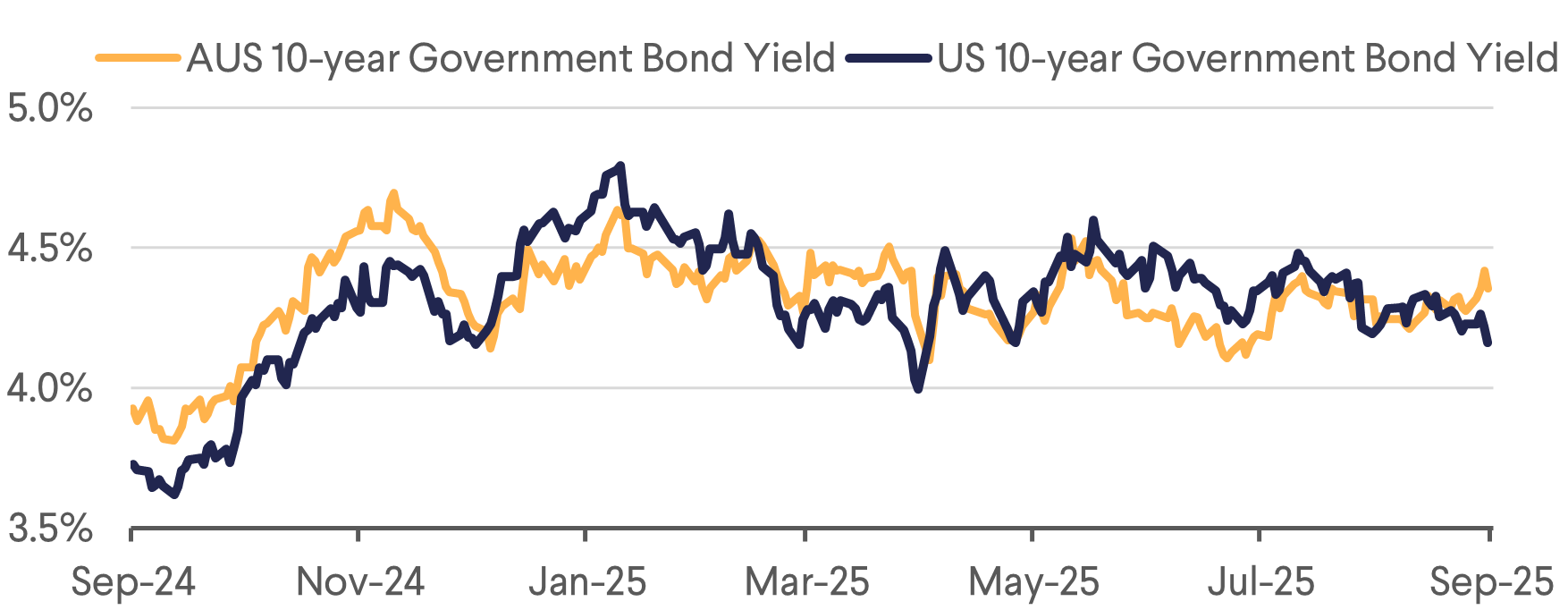

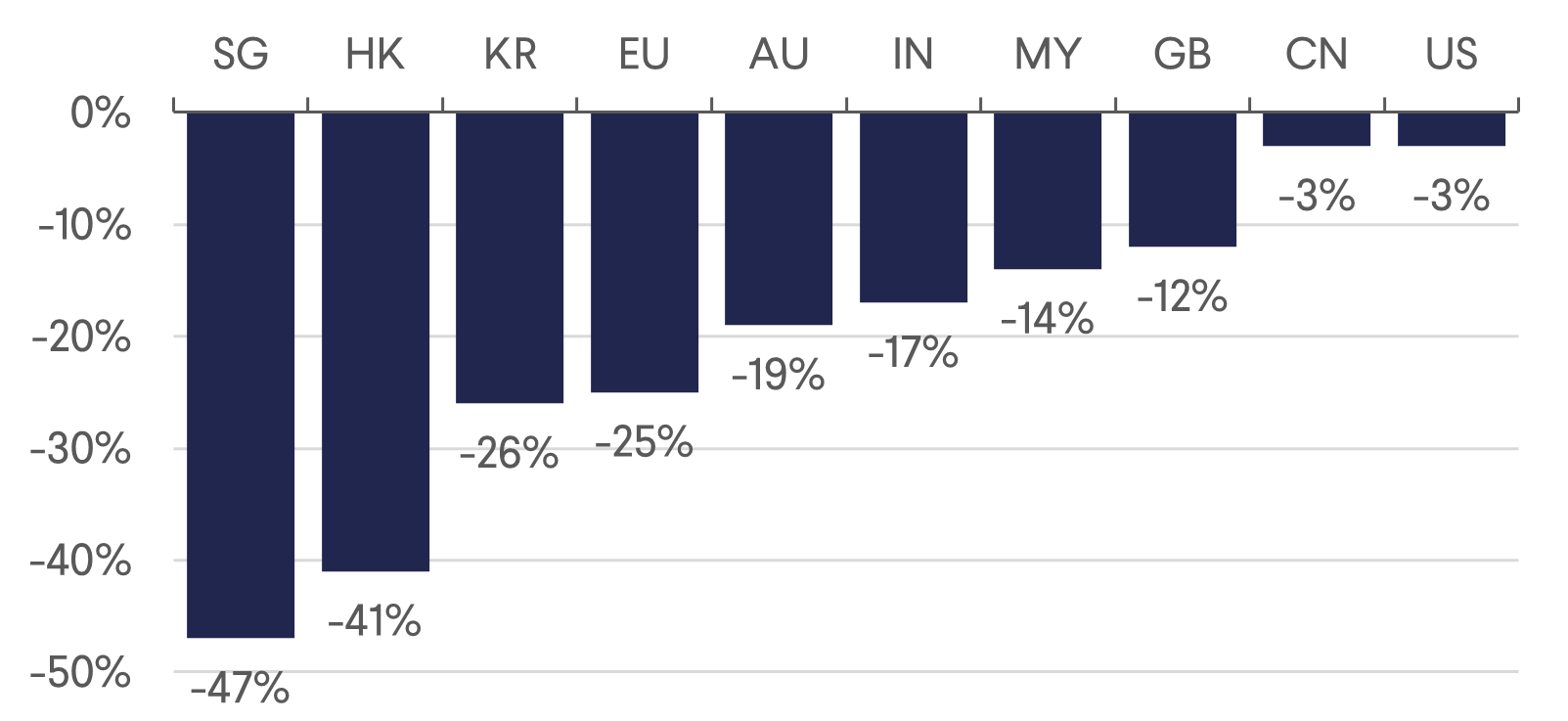

Asian Real Estate Securities have surged over 25% in 2025 on the back of a number of supporting factors, a positive development as we approach the 15-year anniversary of the B&I Asian Real Estate Securities Fund. Anticipation of continued falling rates in the region and weakness in the USD have contributed to strong USD returns. September is historically a challenging month for equities. Given the push and pull between weaker US labor data and higher prices, there is a debate regarding whether rates in the US at the long end will fall and how many cuts we should expect over the next year. Our macro view remains that US labor market weakness will continue, and this will ultimately lead to lower rates in both the front and long end of the curve. Friday’s Non-Farm Payroll confirmed the labor market weakness that was also evidenced in July’s job openings survey (JOLTS). Reported on September 3rd, JOLTS revealed a weakening labor market with job postings falling to their second lowest level since the pandemic and not seen since 2020. Given the weak labor market, a September rate cut is all but certain with the door open to additional cuts before year end. We see any correction in Asian Real Estate securities due to US or Global macro forces as a good opportunity to buy as rates and inflation in the region are falling and rental growth across several asset types remains solid and transactions are picking up. We continue to like Retail REITs in Singapore and Hong Kong, Residential related and Fund Managers in Australia, and cyclical growth focused JREITs (Office, Hospitality, Diversified and Logistics).

Japan

Japanese Developers surged in August following their first quarter reports that generally beat expectations helped by strength in office leasing, residential sales, and hotel operations. We like the fundamentals and the continued corporate governance improvements but also think there is a lack of fresh catalysts in the short term. Given the surge in condominium prices, we also think there is potentially some policy risk to help contain price increases perhaps by limiting foreign investment or other measures. As we mentioned previously, the Chiyoda ward did introduce measures to reduce potential speculation by extending the required holding period. Overall, any measure is likely to have more impact on sentiment for securities than on strength in sales as demand is genuine from end users and condominiums remain affordable for most double income households despite the price rise. Office vacancy levels for existing properties will continue to drop and rent increases are likely to accelerate given the low level of vacancy and continued demand by corporates to expand office space in Tokyo. Large Office REITs now trade above 1x NAV so we anticipate a capital raise by Japan Real Estate (8952) and think if they were to raise that demand would be solid assuming they acquire attractively priced assets from their sponsor, Mitsubishi Estate. Ahead of the LDP Leadership election, PM Ishiba announced his resignation. This is not very surprising as he was expected to be replaced after the leadership election given the weak showing of the LDP in the last election. One of the front runners to replace Ishiba, Sanae Takaichi, is known as an economic policy dove and defense hawk. She is seen as an Abe protégé and in favor of fiscal and monetary expansion. Given the current inflation level and strong wage growth, we think her appointment would hurt sentiment for the JPY and longer dated JGBs. Shinjiro Koizumi, son of the former PM, is also one of the leading candidates and would be seen as less dovish and therefore more positive for the JPY and JGB market. 2Q GDP for Japan rose 2.2% exceeding the 1% expectation so we are hopeful that the BOJ moves on rates in its October meeting as it still appears behind the curve. JREITs have staged a strong recovery from their deep discounts and now are trading around a 7% discount versus the 20% discount since the beginning of the year, despite higher 10y JGB yields. We think the reason is that overall property transactions remain high and JREITs have been selling assets and doing unit buybacks which has attracted investors back to the sector. Unlike the rest of Asia, higher rates do remain a challenge though for the sector and the BOJ’s hesitancy to raise despite higher inflation and growth has led to weakness at the longer end of the curve which may limit upside for the sector. Given the current political environment and the BOJ’s hesitancy to raise rates due to tariff impact concerns, we think interest rate uncertainty will remain high and have a strong preference for cyclical sectors (Office, Hospitality and Diversified). We also still see opportunities in some Logistics names.

Australia

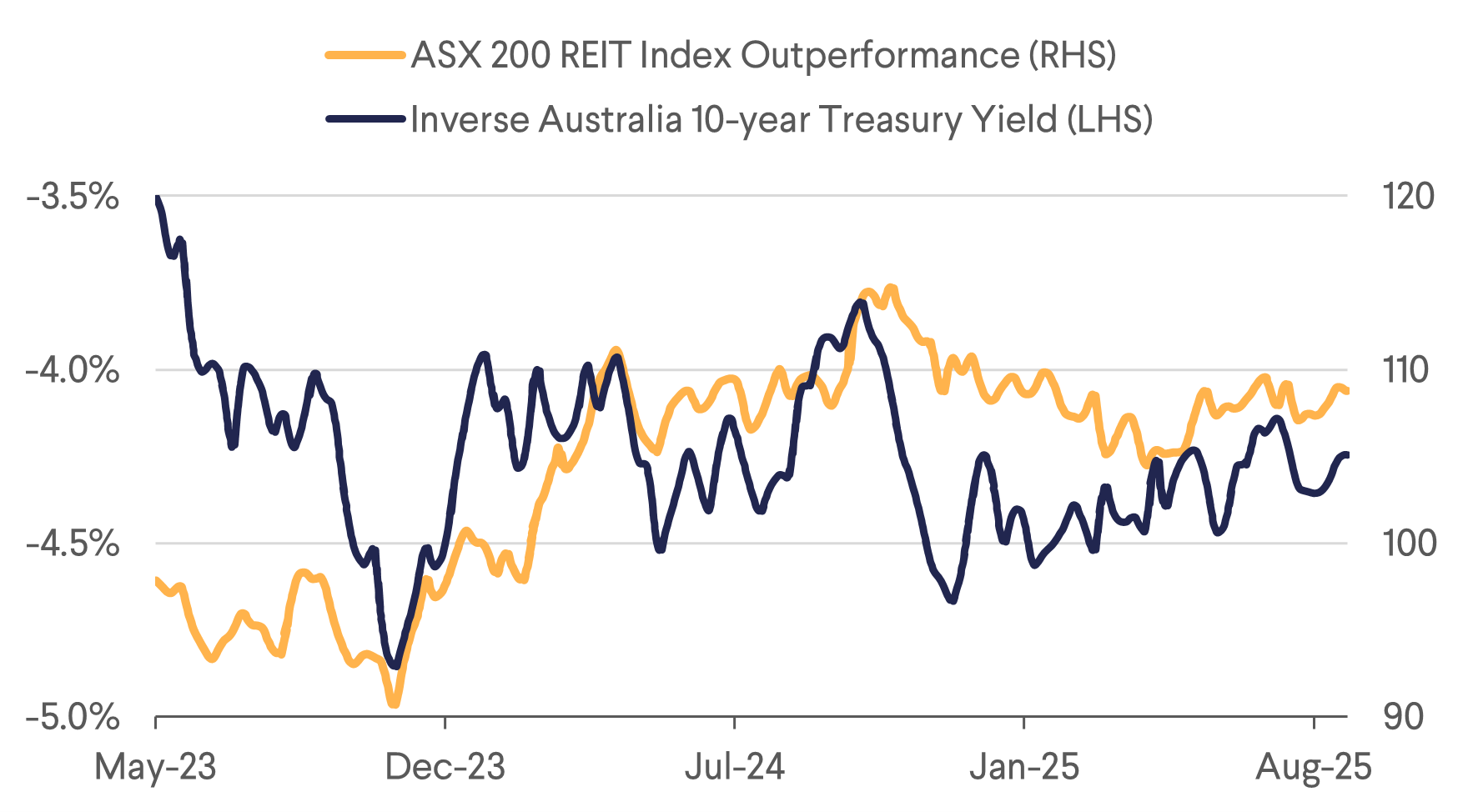

Results in Australia reported in August were strong across the board. We also met with several companies post results and we remain highly convinced that residential, self-storage, fund managers, and retail are the sectors best positioned to benefit from strong demand and lower interest rates. Stockland Group appears set to benefit most from demand-side support that will help first time homebuyers enter the market. With affordability being a large impediment to first time buyers, the Government has expanded its home guarantee scheme that allows buyers to put down 5% instead of 20% without having to pay for Lender Mortgage Insurance. This means that the government is effectively guaranteeing the 15% portion to the banks. In addition to the down payment guarantee, they have removed the income cap and raised the property price limit substantially within the context of the program. For example, the cap in Sydney has increased from AUD 900k to 1.5m. A fall in rates would also help with affordability. The major problem in Australia is supply, and while this does not address this issue, we think transactions and volumes will increase and Stockland is well positioned to deliver properties to first time home buyers due to it large landbank of approved sites. Improving transactions will benefit other sectors where we are exposed like Self Storage (via National Storage) and other residential derivatives like land lease communities. There is also unmistakable evidence that Sydney CBD Grade A Prime Office has bottomed with transactions and investor interest picking up. Net effective rents are now rising by high single-digits. We do not own a pure Office REIT due to the numerous challenges in other Australian markets, but think this improvement will help the likes of fund manager Charter Hall Group and the diversified REIT Mirvac due to their high-quality portfolios. We understand that one large Asian investor is doing due diligence to enter the Office sector after watching the downturn for years. One hurdle facing the sector is that inflation remains slightly elevated and the RBA has become slightly hawkish in their tone. However, historically Australian rates have typically followed US rates and if the US labor market and global growth slows, the RBA may indeed need to follow.

Hong Kong

A jump in HIBOR in mid-August led to a correction in Hong Kong REITs and Developers after a tremendous run with many names up over 30% YTD. We see the move in HIBOR as a normalization as the carry trade offered an unusual “risk free” carry of over 300bps for almost three months. Today, the carry is around 100bps, and the HKD has gone back to the middle of its trading band. At 2.96% this still represents significant interest cost savings for the REITs and will help to drive some DPU growth. We expect a discount between USD and HKD rates to persist and think that 100-150bps seems about right given the HKD band of 7.75 to 7.85 and the continued weakness in the USD versus other currencies. Any cut by the Fed will also help lower borrowing costs further for Hong Kong Real Estate securities. We continue to look for a catalyst for the HK REITs with their inclusion into the HK Stock Connect program with the mainland. Developers have had a strong run as residential markets recover. We expect some profit taking as margins are still under pressure due to higher legacy land cost. We remain constructive on the recovery but think earnings and margin recovery will be required for the next leg. Dividend yields which were supportive have dropped into the 4-5% range down from more than 6% earlier this year for names like SHK Properties. One short term potential catalyst is the Hong Kong policy address on September 17 where it is possible that they will elaborate on Hong Kong Property Connect. This is a potential policy that would make it easier for mainland buyers to purchase property in Hong Kong and was recently raised by Financial Secretary, Paul Chan. We have also been hearing from that discretionary retail is seeing some improvement with roughly five million tourists visiting Hong Kong last month and so we would not be surprised to see landlords continue to perform well given this improvement which is just starting.

Singapore

Nowhere else in the region has seen interest rates drop so precipitously as in Singapore. CapitaLand Ascendas REIT recently issued green notes for 7 years at 2.34%. Earlier this year they purchased a Business Park asset that serves as HQ for Shopee and was below market rent on a 6% cap rate and a Data Center on a 7% cap rate. Given the recent drop in rates the spread between cap rates and debt costs have become large, and this will help some REITs make accretive acquisitions. In addition, as debt maturities are short in Singapore, we expect many of the SREITs to benefit from falling interest costs when they refinance their upcoming debt. We remain extremely optimistic on SREITs at these levels as they have lagged all other regions despite having the largest drop in funding costs.

| Company | Quantum | Coupon | Tenor |

| CLAR | SGD 700m | 2.34% | 7 years |

| FLT | SGD 100m | 2.45% | 8.5 years |

| MPACT | SGD 200m | 2.45% | 7 years |

| CIT | SGD 200m | 2.47% | 5 years |

| UOL | SGD 300m | 2.78% | 7 years |

| Equinix | SGD 650m | 2.90% | 7 years |

Source: SGX, Company Data, HSBC

Download the PDF version of the report here