Background

In December we attended the Nareit REITworld Conference in Dallas, where we joined 21 management meetings and toured five Sunbelt residential properties over three packed days. While discussions were insightful, the tone was subdued and attendance thin, reflecting muted REIT performance in 2025 (+2.3% total return) versus the S&P 500 (+17.9%) and Nasdaq (+20.8%). Management teams voiced frustration over weak share prices and limited inflows despite healthy fundamentals, strong balance sheets, and declining supply.

The best opportunities often emerge when a sector is overlooked, and REITs fit that description today. Beneath the surface, there are encouraging signs: balance sheets remain conservatively levered, debt spreads are tightening, new supply is falling, and shareholder aligned management teams are recycling capital and repurchasing shares at steep discounts to NAV. After a difficult year, we believe the valuation and setup for REITs heading into 2026 is promising.

Big Picture Takeaways

Less Macro Uncertainty Talk – More Company Specific Focus

At the Nareit NYC Conference in June, most of the discussion centered on broad macro themes such as tariffs, the 10 year yield, and immigration policy. In Dallas, those topics barely came up. We see this as a positive shift, with investors and management teams now focused less on unpredictable external macro forces and more on the actions they can take to drive shareholder returns.

After the wave of announcements and executive actions early in 2025, many participants appear to have adjusted to the new environment and expect a calmer backdrop in 2026. That sense of stability could be tested in mid 2026 when President Trump appoints a new Fed Chair to succeed Jerome Powell, if not before.

Most positive, management has shifted emphasis towards company fundamentals, capital allocation, and operational execution rather than macro volatility.

Buybacks are Attractive

When public REITs trade at meaningful discounts to NAV or at implied cap rates well above private market valuations, buybacks become value creative and, often, the best use of capital.

Many REIT CEOs who complained about their share price performance despite strong fundamentals and outlook in 2026 are putting their money where their mouth is. Several management teams told us they plan to deploy cash or recycle assets at low private market cap rates and use the proceeds to repurchase stock at much higher implied yields.

We are already seeing this play out. Timber REIT Weyerhaeuser has a $1 billion buyback authorization, equal to 6% of its market cap, while Kimco Realty approved a $750 million program in November, representing 5.5% of its market cap. The most striking examples are in the residential sector, where apartment REITs are trading at implied cap rates far above private peers. For example, AvalonBay (AVB), the largest apartment REIT, trades at a 6.2% implied cap rate versus mid 4% to mid-5% range for private transactions, an attractive spread of 70-170 basis points. This difference is largely driven by private markets pricing in an expectation that long rates will continue to fall, leading to higher asset prices and lower cap rates. AVB acted decisively to take advantage of this discrepancy, repurchasing $488 million of shares in the second half of 2025 at a 16% discount to NAV, even while funding a $3 billion development pipeline. The company funded the repurchase of its stock at a higher implied cap rates in part with dispositions done at lower cap rates. In Q3 the company sold four assets in Washington DC for $450m at a 5.5% cap rate and a property in Seattle Washington for $63m at a 4.6% cap rate.

Similarly, residential REITs Camden Properties (CPT) bought back $50m of shares, Equity Residential (EQR) bought $99m, Mid America Apartments (MAA) bought $14m, UDR bought $100m, and AMH bought $100m. This is a strong sign from these residential names that they think their stocks are trading at discounts to the intrinsic value of their businesses. For long term investors, this alignment of capital allocation and conviction is an encouraging sign that the sector is positioning itself for recovery.

REIT | 2H25 Buybacks Announced ($m) | % of Total Shares | Average Buyback Price ($) | Implied Cap Rate | NAV per share ($) | Discount to NAV |

AVB | 488 | 1.9% | 181 | 6.1% | 227 | -20% |

CPT | 50 | 0.4% | 107 | 6.1% | 131 | -18% |

EQR | 99 | 0.4% | 64 | 6.1% | 82 | -22% |

ESS | - | 0.0% | - | 5.6% | 299 | - |

MAA | 14 | 0.1% | 132 | 6.1% | 159 | -17% |

UDR | 100 | 0.8% | 37 | 6.6% | 51 | -27% |

VRE | - | 0.0% | - | 6.1% | 22 | - |

AMH | 100 | 0.7% | 32 | 6.5% | 45 | -29% |

IVNH | - | 0.0% | - | 7.0% | 44 | - |

Supply Falling – Will Demand Hold Up?

In most real estate sectors, it’s now more expensive to build than buy assets, as rising land, material, and labor costs make new developments financially unfeasible. Development activity continues to decline across most sectors (Data Centers are an outlier), constrained by elevated construction costs and persistently high interest rates. At the same time, tighter financing conditions marked by higher borrowing costs, reduced capital availability, and lenders prioritizing refinancing over new construction have made new projects harder to justify.

Developers are also having to contend with lingering supply‑chain and labor constraints, as well as a softer economic backdrop that has tempered confidence. These pressures are reinforcing a supply‑demand imbalance that benefits existing property owners. Even once booming sectors like Industrial, Storage, and Apartments are seeing pauses in supply. In our view, this trend is one of the most constructive in the real estate space and should support landlords’ ability to raise rents above inflation over time.

In recent conferences, investor meetings often focused on the path of new supply while the demand side of the equation was taken as a given. In Dallas, the focus shifted to demand. While confidence in declining supply is high, the concern heading into 2026 is whether demand will hold up. Job growth remains the key driver of office and apartment demand, and, when employment weakens, spending slows across sectors such as retail, hotels, and casinos.

In 2025, there were 1.17 million job cuts, up 54% YoY. Reductions in government spending, the replacement of entry level roles by AI, and tariff related volatility have all contributed to the rise. This backdrop has investors questioning how resilient demand will be if layoffs continue.

Management teams we met with largely agreed: supply is falling and fundamentals look strong into next year, giving them confidence to raise rents. But they also acknowledged that this depends on unemployment remaining contained. If job losses accelerate, demand could soften and temper the recovery story in sectors such as apartments, office, industrial, and storage.

Aging of the US Population

Success across several healthcare subsectors including senior housing, skilled nursing, and medical office buildings can be attributed to one unifying concept - the aging of the US population. This trend is one of the primary drivers behind the incredible outperformance of the healthcare sector (28.5% TR) vs all REITs (2.3% TR) in 2025.

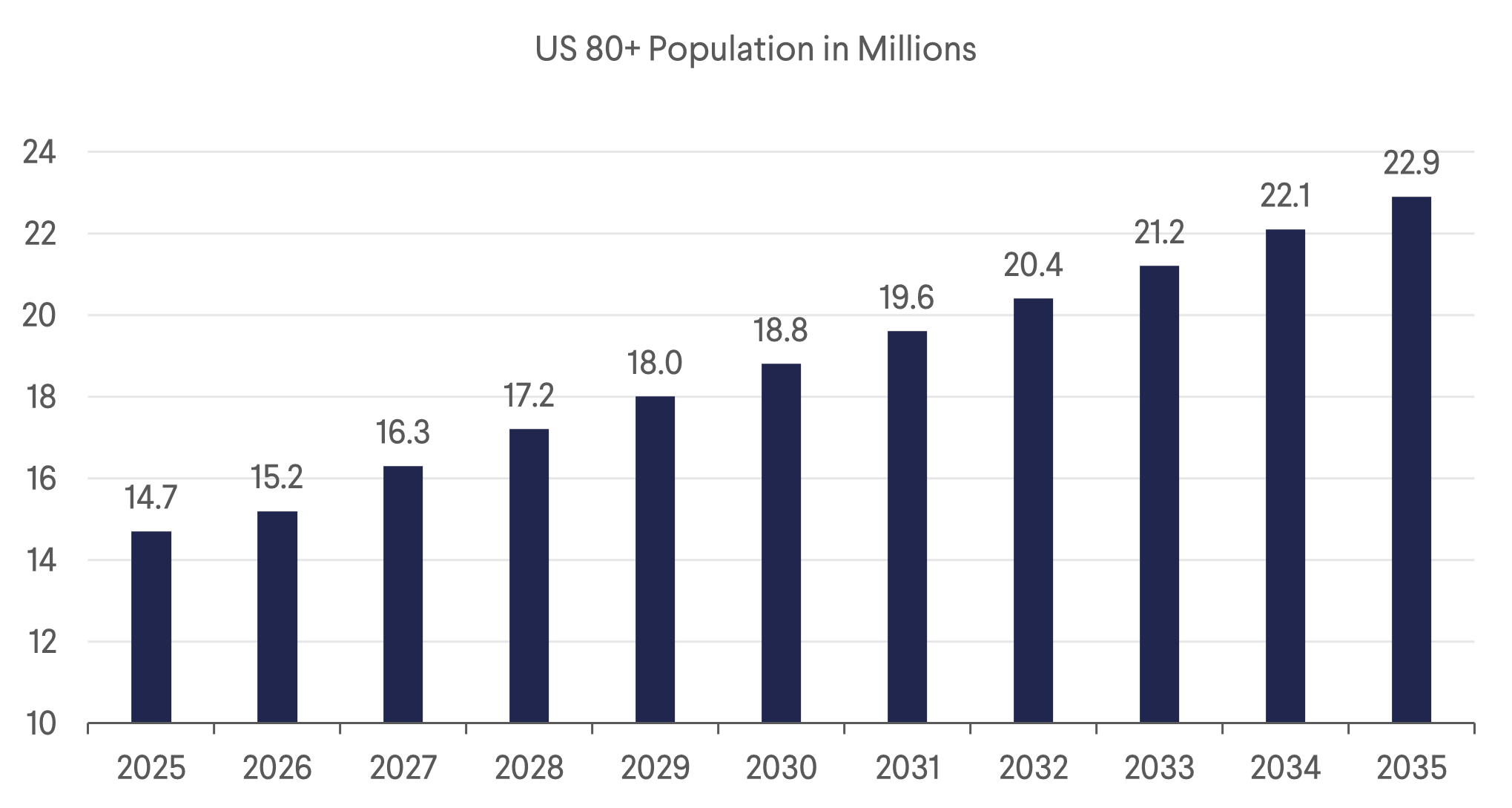

The probability of a person needing greater medical care whether that be elective surgery or round the clock nursing increases dramatically when they turn 80 years old. Currently the US 80+ population stands at 14.7m, or about 4% of the total population. Over the next decade this 80+ group is expected to grow by 55% to 23m. Therefore, demographic growth tailwinds in the 80+ cohort will continue to support strong demand, occupancy, and rent growth in the REIT healthcare sector.

Sector Takeaways

Apartments

Apartments had a disappointing year, underperforming the REIT index by -10.8%. Across our meetings, the apartment REITs presented a consistent message: fundamentals remain intact, supply is finally rolling over, but public valuations imply cap rates well above those being used in private transactions. This disconnect is striking. Merchant developer activity has collapsed, development yields remain in the 6-6.5% range, and private buyers continue to underwrite aggressively, often at cap rates (mid-5% or usually lower) meaningfully below where public REITs trade (+6%). The result is that companies like AVB, CPT, and UDR are looking to sell assets to private market buyers and use proceeds to buy back their own stock at implied yields north of 6%. This a capital allocation arbitrage too compelling to ignore. AVB alone has repurchased $488 million of stock, funded by retained cash flow and $500 million of annual dispositions.

The opportunity in Apartments is becoming more clear as supply moderates and concessions burn off. Rent growth should normalize back toward the 3-4% range, first in coastal markets where new deliveries are already limited and then in Sunbelt markets where higher supply is still being absorbed. The risk in apartments at this point lies squarely on the demand side. Sunbelt teams we met with such as MAA and IRT were candid that job growth, migration, and household formation have all softened, pushing the recovery timeline into late 2026 or even 2027.

While demand may be delayed, implied cap rates are higher and we expect a meaningful reversion in Sunbelt REIT valuation multiples when new rent growth turns positive. For example, MAA’s latest report had new rents coming in at -5.2%.

Management teams emphasized that tenant credit remains stable, rent breaks are limited despite increasing layoffs, and the U.S. renter/owner ratio continues its slow shift towards increasing renter numbers as the cost to rent continues to fall relative to the cost to own.

For long term investors, the combination of discounted valuations vs private market transactions, disciplined capital allocation via buybacks, and firmly declining supply sets up a favorable backdrop as long as job cuts do not accelerate meaningfully.

Single Family Rental

The SFR REITs struck a more tempered tone. Rent growth is clearly decelerating as the consumer is more stretched, competition from build to rent operators intensifies, and leasing velocity slows. AMH noted that blended rent growth is now running at 3% (vs AVB at 1.5%), the time to sign leases in taking longer, and market rent growth is decelerating to apartment-like levels. Management expects SSNOI growth of roughly 3% going forward, a meaningful downshift from the past several years. SFR is naturally becoming a more mature sector and the slowing rent growth converging with apartments and MH/RV reflects this.

The valuation story mirrors apartments, as SFR REITs trade at a steep discount to private market values. AMH has leaned into the dislocation, selling single family homes at cap rates in the high 3% range and repurchasing $100m stock at implied yields closer to 6.5% in 2H25. The AMH CFO said dispositions, retained cash flow, and incremental leverage capacity are all being redirected toward development and buybacks. The AMH CEO reiterated that he believes the best term opportunity for the company remains developing SFR communities in supply constrained submarkets.

Office

The Sunbelt office story continues to improve, Cousins Properties (CUZ) is the clearest example. Management was direct about the valuation disconnect and emphasized that fundamentals are strengthening, not deteriorating. Their late stage leasing pipeline has grown from roughly 715,000 square feet in the third quarter to about 1.2 million square feet today, an increase of nearly 70 percent in just a few months. This is the strongest leasing velocity the company has seen in years and is already showing up in occupancy, which sits near 90% across a portfolio concentrated in the most desirable submarkets in the region such as Uptown in Dallas. With no new supply coming online and office inventory shrinking, CUZ expects occupancy to move above 90% by the end of 2026, and management believes rent growth will accelerate as demand continues to grow.

Meanwhile, Kilroy Realty (KRC) shares have risen more than 7.5% over the past six months while CUZ is down roughly -5.6%, yet KRC’s fundamentals remain far weaker. At this point it seems KRC is outperforming on “vibes”, as investors are hopefully awaiting a recovery in the city driven by AI leasing demand. Economic occupancy is about 81%, cash rents are down -15% YTD, and the Q2 2026 roll off of capitalized interest on the Flower Mart development will pressure earnings. Leasing in San Francisco and Los Angeles remains uneven, concessions are still elevated, and large blocks of space continue to become vacant.

Highwoods (HIW) sits between the two, with occupancy gradually improving and rent trends firming in Dallas and Charlotte as concessions ease and tenant improvement packages moderate. Taken together, the Sunbelt offers the cleanest path to recovery: leasing pipelines are expanding, occupancy is rising, and the best submarkets are showing real pricing power. West Coast markets may eventually stabilize but stock price performance is getting well ahead of the fundamentals, creating a more attractive setup in the Sunbelt than current share prices reflect.

Gaming

Our meetings with Gaming and Leisure Properties (GLPI) reinforced its role as a stable partner of choice for gaming operators. Management expressed confidence in the portfolio and capital position, pointing to long‑duration leases, strong tenant coverage, and a healthy operator base. GLPI has committed roughly $3 billion to investment and development projects over the next three years, raising investor concerns about leverage. Management highlighted $750 million of cash on hand, $363 million from a recent forward equity issuance, $1.8 billion of liquidity on its credit line, and a balance sheet at 4.4x net debt to EBITDA, all of which should allow it to fund commitments while keeping leverage below its 5.5x target. A key project is Bally’s Chicago casino, scheduled to open in 1H 2027, which will add visibility to cash flow growth and ease concerns about Bally’s ability to execute while managing its debt load.

Channel checks confirmed that VICI Properties (VICI) discussions in Dallas focused almost entirely on the Caesars regional master lease, which remains the key overhang on the stock. Coverage sits at 1.1x or less, representing $725 million annually and 23% of total rent. While VICI emphasized the binding nature of the master lease through 2035 and its track record of managing similar tenant issues, rent cuts appear possible and investor sentiment has weakened accordingly.

We expect VICI’s management team to address the Caesars issue directly and work toward a resolution. Options include Caesars exiting weaker casinos while making concessions to VICI, new operators stepping in, or in the worst case a rent reset to stabilize coverage. Caesars has recently invested more than $500 million into Atlantic City and New Orleans properties, underscoring its commitment and reducing the likelihood of walking away. While timing remains uncertain, VICI has successfully managed coverage challenges before, and we believe management credibility, tenant reinvestment, and multiple paths to resolution should ultimately restore confidence. With a 6.5% dividend yield and proven AFFO per share growth of 3-4%, VICI offers a compelling 9.5% total return profile.

With disposable income tightening and job growth slowing, Las Vegas is feeling the pullback, especially among Millennials and Gen Z who are less interested by traditional casino gambling. The slowdown shows up clearly in the year to date airport data, with Harry Reid International handling 50.6 million passengers in 2025, down from 58.4 million in 2024, a 5.5% decline. As online gaming continues to pull demand away from physical casinos, operators and landlords such as VICI are leaning into a broader experiential model. The focus is shifting toward high quality dining, major concerts and musician residencies, and large scale events like the Las Vegas Grand Prix, NFL and NHL games, and major conventions. The goal is to make Las Vegas a more diversified destination where entertainment, sports, and hospitality carry more of the load in attracting visitors.

Healthcare

Healthcare REITs remain one of the strongest long term growth stories in real estate. An aging population and a lack of new supply are pushing senior housing (SHOP) occupancy toward 90%, a level that unlocks significant operating leverage. We view the opportunity to improve outdated operating practices and institutionalize the SHOP and skilled nursing (SNF) subsectors as analogous to the opportunity in apartments 20 years ago. However, in seniors housing there is still significant juice to squeeze in occupancy, margin, and revenue growth. This is why we are positioned in REITs with the largest SHOP exposure such as Welltower (WELL) and American Healthcare REIT (AHR), and why so many REIT peers are working to expand their SHOP footprint.

Our meetings with Ventas (VTR) underscored the scale of this opportunity. US occupancy remains in the mid-80% range, leaving room to move into the low-90s and eventually mid-90s, where incremental margins are strongest. Ventas believes it is redefining “stabilization” in senior housing, targeting high 90% occupancy while leveraging dynamic pricing, data analytics, and operational sophistication to modernize what has long been an antiquated industry. With limited new supply, favorable demographics, and expanding margins, Ventas sees a multi year runway for growth. Management emphasized that success in this sector depends less on “location, location, location” and more on “operator, operator, operator.”

One of our best meetings was with CareTrust REIT (CTRE), a skilled nursing REIT, which reinforced this operator centric theme. CTRE is building organizational depth, expanding headcount, and investing in analytics to better underwrite and monitor operator performance in both the US and UK. Their disciplined approach to acquisitions, focus on well covered leases, and willingness to trade yield for rent coverage reflect a defensive credit investor mentality. CTRE’s pipeline includes US SHOP opportunities and UK care homes, with memory care viewed as an area of upside. Skilled nursing remains a high barrier market where regional operators often outperform, and CTRE is positioning itself as a REIT that can identify, underwrite, and partner with the best operators.

Asset Tour Pictures

Dallas Apartment Property Tours (AVB, CPT, UDR) – 8 December 2025

|  |

|

Download the PDF version of the report here