Background

We attended the Nareit Conference in Midtown, NYC, and toured apartment and entertainment properties, conducted 36 meetings with management teams across 15 real estate subsectors, debating ideas with a diverse group of analysts and investors.

Prior to the conference, our US and Global PM visited our Austin office. We used this opportunity to test our Sunbelt theses, touring office, multifamily, storage, and senior housing properties. We came away from these Austin tours incrementally more positive on Sunbelt markets due to resilient job and population growth along with rapidly slowing supply levels from 2025.

Visiting Manhattan annually since 2021, we were struck by the city's resurgence during this trip. The subway was notably crowded, with ridership 13% higher than in 2023 but still 25% below pre-Covid levels due to safety concerns and continued WFH. Apartments are well-occupied with positive rent growth due to favorable supply-demand dynamics. Sentiment on Class A office leasing remains cautiously optimistic despite WFH stress, with the Class A vacancy rate stabilizing at around 14.5%.

Big Picture Takeaways

Resilient Labor Market Leading to a Resilient US Consumer and Economy

Despite higher borrowing costs and inflation weighing on real estate valuations and rent growth, the US economy remains robust, thanks to a strong labor market and resilient consumer spending. Management teams highlighted that REITs benefit directly from ongoing hiring and wage increases by US businesses. The Labor Department’s report on the Friday following the Nareit conference confirmed this, showing 272,000 jobs added in May (versus an estimated 190,000) and a 4% YoY increase in hourly earnings. We recognize the risk of a cooling labor market and remain invested in companies with resilient business models and strong balance sheets to mitigate this.

REIT performance has been negatively impacted by the sharp increase in interest rates, and the recent strong labor print will make the Federal Reserve even more reluctant to cut rates quickly. However, a respected REIT CEO pointed out that REITs with solid balance sheets and supportive supply-demand fundamentals—like those we invest in—will perform well against other equities once interest rate trends become clearer. Recent fluctuations in the US 10-Year Treasury yield, ranging from 4.27% to 4.62%, have heightened uncertainty in real estate. We believe that as inflation declines and Covid-related labor and supply chain issues resolve, rate stability will improve, benefiting REITs. For REIT fundamentals, mere stabilization in interest rates is more critical than a sharp decrease.

Lack of Generalist Positioning – Threat or Opportunity?

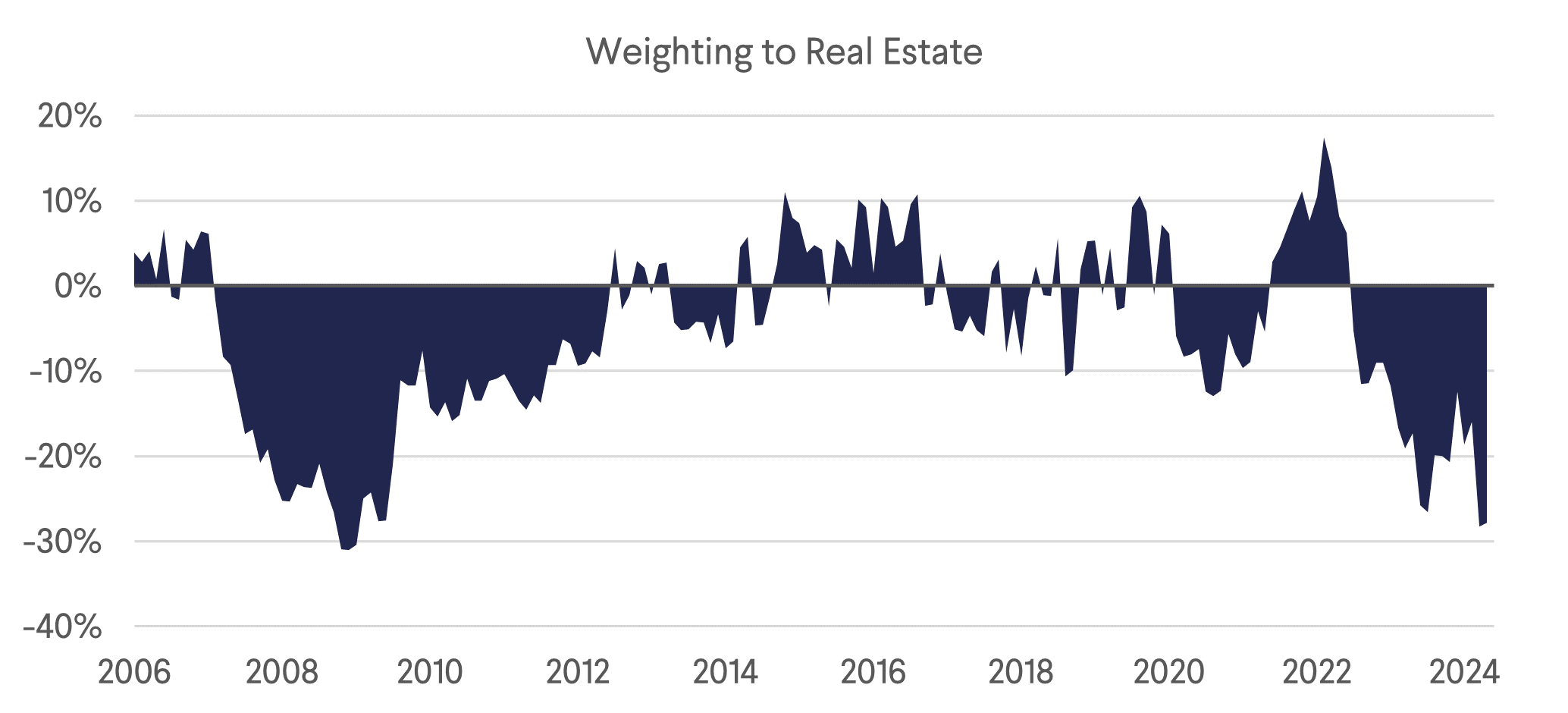

Several REIT management teams and investors at Nareit lamented the lack of interest from generalist (non-REIT specialist) investors in the REIT sector. While dedicated REIT investors were well-represented at the conference, generalist participation was noticeably low and reflects the level they claim to be underweight real estate. One driver of negative news around REITs is the oft-heard misconception that challenges in the office sector equate to distress in all commercial real estate (CRE). The US Office Sector dominates real estate news but represents less than 4% of the FTSE NAREIT benchmark. Meanwhile, alternative sectors like data centers, senior housing, and single-family rentals, which have strong supply-demand dynamics, are growing in significance within the benchmark but are largely ignored by generalists.

To this point, the latest (May 2024) Fund Manager Survey by Bank of America noted that global fund managers are the most underweight real estate since June 2009. Following the accepted truth and herd does not normally lead to the best performance over time so the current extreme underweight represents an opportunity for contrarian investors who understand the REIT landscape and are willing to diverge from prevailing market sentiment.

Prudent Capital Allocation Strategies Position REITs to Capitalize on Distress

At the conference, REIT management teams acknowledged that future capital allocation decisions will need to adapt to a higher interest rate environment. There was a consensus that interest rates and borrowing costs are unlikely to return to the historically low levels seen from 2009 to 2022. Higher rates penalize excessive leverage but benefit companies with disciplined balance sheets and prudent growth plans. This could create asset buying opportunities for REITs, especially since excessive leverage is more common in private real estate markets. While most REITs went into this interest tightening cycle with the safest balance sheets on record, those that do have higher leverage are responding by selling non-core properties to pay down debt and position their balance sheets to take advantage of any distress in the private markets.

These distressed opportunities have yet to materialize en masse due to two factors: (1) Lenders prefer to defer repossession and accept partial payments rather than manage operationally intensive real estate assets directly. (2) There is substantial private capital, including entities like Blackstone, which bought two residential REITs for USD 13 billion in 2024, waiting to acquire distressed assets. This influx of capital has helped to sustain property prices, keeping many distressed properties off-market. Still, many REITs are actively evaluating acquisition opportunities, including distress in private markets.

Supply-Demand Fundamentals Inflecting Slowly but Positively

Most US REITs, except Data Centers and Senior Housing, are trading at NAV discounts, curtailing equity issuance and slowing external growth through acquisitions and developments. Development in private markets is also slowing due to increased project hurdle rates and persistently high construction costs. Since we last wrote about this topic earlier this year following the Miami Real Estate Conference, the outlook has continued to improve across asset classes, as existing projects reach completion and new construction starts continue to decline due to a combination of higher rates, construction costs, and labor costs. This slowly unfolding scarcity of new supply continues to provide a significant advantage for existing real estate owners and landlords, as the market absorbs existing space. For example, Retail REITs continue to see shopping center properties trade at considerable discounts to replacement costs, making new construction financially unwise at a time when a notable amount of inventory (c. 1% annually according to one REIT we met) is being demolished.

Due to the long construction timelines which lag construction starts, the impact on inventory is gradual. However, sectors currently experiencing oversupply, such as Life Science and Sunbelt Apartments, are expected to see a significant decline in supply starting in 2025, with a sharp drop-off by 2026. This reduction is likely to lead to future undersupply, increasing pricing power.

Large pharma companies’ success and cheap financing during Covid made Life Science real estate highly attractive. Developers, responding to this trend, built a surge of life science buildings in Boston, San Diego, and San Francisco based on speculative demand. These projects, now reaching completion, are entering a saturated market, with 16 million sq. ft. of vacant space expected in 2024. Nonetheless, overall development is slowing (albeit off historic levels), and we anticipate a 75% reduction in new vacant supply in 2025, setting up a crucial turning point for the sector.

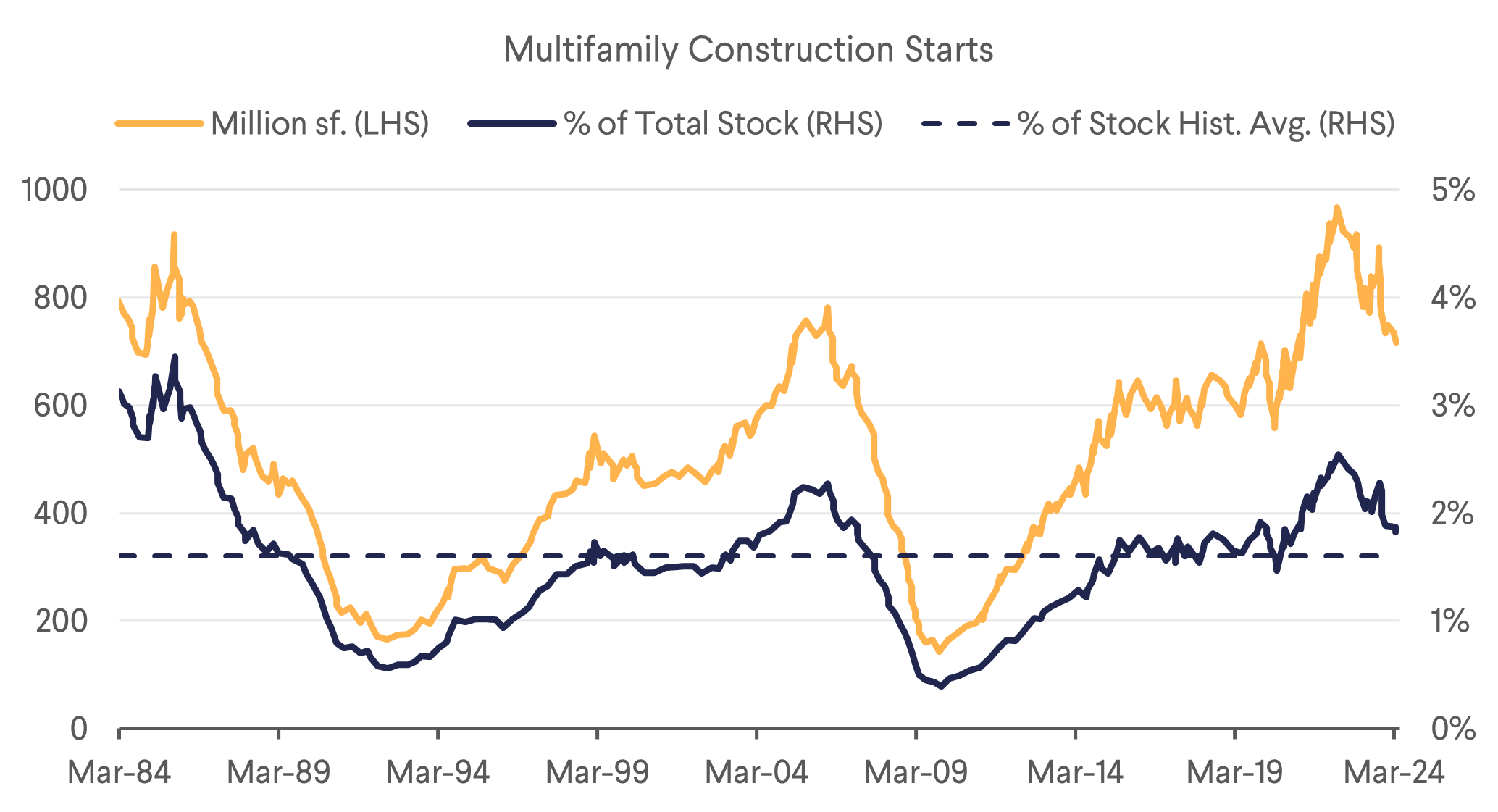

In 2021 and 2022, apartment owners in Sunbelt markets raised rents significantly, fueled by strong in-migration driven by corporate relocations and more lenient Covid restrictions. Capital and developers rapidly expanded Sunbelt apartment construction, leveraging cheap debt. By mid-2022, nearly 1 million apartment units were under construction in the US, more than double the 5-year annual average of 440,000. With typical two-year construction timelines, these units are now coming online, mainly in Sunbelt markets, leading to decreased rents and occupancy.

Discussions with apartment management teams in Austin and New York suggest that we have reached the peak of this oversupply cycle in the Sunbelt. While apartment starts as a percentage of inventory will remain high through 2024, we expect a return to historical levels by 2025 and a further decline in 2026. This wave of supply, the largest in 40 years, coincides with record apartment absorption, also the highest in 40 years. Following our Austin tours—where new supply as a percentage of inventory was 11% in 2024, the highest in the nation—we anticipate the sector will benefit from reduced supply and sustained demand due to a persistent shortage of affordable, well-located housing in major metro areas.

Sector Takeaways

Data Center and Telecom

Nowhere in the REIT space is the supply-demand imbalance more pronounced than in the Data Center market. Demand is soaring due to the growth of cloud computing and new needs from artificial intelligence (AI). One data center executive at the conference informed us of a hyperscale cloud provider that canceled its plans to relinquish space, opting instead to retain unused capacity “just in case.” This indicates a scarcity mindset prevailing on the demand side.

On the supply side, barriers include power availability, transmission issues, and community opposition to new data centers or high-voltage lines, i.e. “NIMBYism.” The Netherlands was cited as one market that has resisted the infrastructure investments needed for significant new data center development. These constraints create a favorable pricing environment for existing operators. Large blocks of capacity are the most coveted commodity right now, and US Data Center REITs are responding by freeing up capacity through efficiency gains within their existing portfolios and strategic churning of customers. Although conversion of cryptocurrency mining facilities into data centers has been suggested, this solution is unlikely to resolve the supply bottleneck because most crypto mining sites of scale are in undesirable markets for key tenants.

We also maintain a positive outlook on Tower REITs, driven by increasing data demand, with average cell phone usage rising 20-30% annually. Data demand growth is accelerating, and towers remain the most effective method for deploying spectrum at scale. With only about 50% of US Towers upgraded to 5G, there is significant long-term growth potential in the space. The Federal Communications Commission’s spectrum plans for 6G are largely compatible with existing towers and small cells. Existential threats from new technologies, such as low Earth orbit satellites, remain speculative at this stage.

Storage

Before the conference, we toured two assets with Storage REIT National Storage Affiliates (NSA) in Austin and were impressed by their digital transformation, with 40% of leases now signed online compared to 0% pre-pandemic. During the conference, NSA announced the internalization of their remaining Participating Regional Operators (PROs), which we estimate will boost per share cash flow by 5-7%. Storage REITs, which benefit from housing moves, have struggled due to low apartment turnover and a stagnant housing market. However, we see potential undervaluation, as storage demand could rise with increased home transactions spurred by greater interest rate certainty.

Healthcare

We had some of our most bullish tours in Austin and meetings at the conference with Senior Housing and Skilled Nursing (SNF) REITs. These sectors cater to the growing population of aging Americans, with the 65+ population expected to increase from 56 million in 2020 to 73 million by 2030—a 30% rise. However, the supply of facilities and beds remains largely stagnant due to high construction costs, challenges from Covid, and regulatory barriers, leading to a significant supply-demand mismatch in the coming years.

Healthcare REITs like Omega Healthcare (OHI) and Welltower (WELL) are benefiting from this imbalance. Both stocks have rebounded from their Covid lows and now trade at premiums to NAV. OHI’s occupancy has risen to 80.5%, 350 basis points above pre-Covid levels. Along with improving occupancy, OHI’s tenants have seen increased state reimbursements and a return of workers to the skilled nursing sector post-Covid, boosting EBITDAR coverage to above pre-Covid levels.

The SNF sector is a lower-margin business with high operational leverage due to the intensive nature of elder care. Poorly managed operators have struggled, leading many private investors to divest assets. OHI, with 32 years of specialization in SNFs, is capitalizing on this distress by acquiring properties at a 10% cash yield, about 200 basis points above their cost of capital. This year alone, OHI has acquired $400 million in assets at these opportunistic levels, filling the void left by distressed private investors.

Life Science

Our meetings with Life Science companies unsurprisingly focused on supply. While the Life Science market is undoubtedly oversupplied, market leader Alexandria Real Estate (ARE) highlighted that occupancy in their prime cluster assets remains strong at 94.6%. They have also pre-leased 63% of their extensive 5.5 million square feet development pipeline through 2027, primarily to existing major pharmaceutical tenants. Despite current market sentiment, we believe their high level of pre-leasing reflects robust demand for their specialized “mega-campus” model. While the Life Science sector may face short-term challenges until supply diminishes, we are cautiously optimistic on the long-term fundamentals. Management anticipates a cyclical trough in the sector, with supply expected to decline sharply in 2025 from historically high levels.

We expect ARE to be classified soon by the FTSE/Nareit Benchmark as a healthcare company, which we will improve sentiment and further highlight its differentiation from standard office to generalist investors. Coupled with increased venture capital funding, evidenced by a 25% quarterly increase in VC funding for Bay Area Life Science companies in 2024, the outlook for ARE in 2025 looks much improved following its derating, especially given its current valuations of -18% to NAV and a Price to FFO multiple -35% below its 10-year average.

Office

Our conversations with Office REITs were surprisingly upbeat, with companies publishing strong QoQ leasing numbers, in many cases on the back of strong Q1 results. Office REITs expressed eagerness to replicate their post-GFC playbook of acquiring quality office towers at steep discounts, and many have already started acquiring at attractive cost bases. While West Coast markets continue to be the laggards due to subdued demand from large tech tenants, multiple Office REITs informed us that San Francisco is now the strongest market on the West Coast. This stands in stark contrast to last summer’s weekly headlines about the city entering a “doom loop.” Well located grade-A offices with state of the art amenities remain in demand.

Apartments

In Austin, we had the opportunity to tour UDR, Inc. (UDR) and Independence Realty Trust (IRT) apartment assets in Austin and speak to regional managers. Touring assets is especially interesting in Austin, as the city is seeing some of the highest amounts of oversupply in the country. However, this is being offset to some degree by high absorption, driven by some of the strongest job growth in the country.

After our visits, some of our most anticipated and interesting meetings in New York were with the Sunbelt Apartment REITs. We were not alone in our interest, as a Citi analyst we spoke to said Sunbelt REITs Mid America Apartments (MAA) and Camden Properties (CPT) were his most highly requested meetings. Coastal REITs with lower incoming supply have steadily outperformed their Sunbelt peers over the past two years, due to higher occupancy and rental growth. This is reflected in valuations as Coastal Apartment REITS trade on average at a 5.7% cap rate, while Sunbelt Apartments trade closer to 6.1% implied cap rates. While the discount of Sunbelt to Coastal apartments is justified, the discount of Sunbelt Apartment REITs to their private peers is not.

Lennar, a US homebuilder, is marketing a portfolio of 11,000 luxury apartments in the Sunbelt, expected to be sold within a cap rate range of 5.25-5.5%. This represents a spread of 60-85 bps compared to similar quality portfolios in similar locations owned by REITs. This cap rate divergence suggests undervaluation in Sunbelt Apartments, potentially leading to repricing after the details of this pending sale become available.

Sunbelt Apartment names have underperformed due to record-high supply levels, but occupancy remains relatively stable due to job growth and absorption rates. We expect supply pressure to peak in Q2 and Q3 of 2024. Despite this, companies like CPT, MAA, and IRT are experiencing accelerating rental growth MoM in the peak leasing season. New lease growth will remain negative this year for Sunbelt apartments and blended rates will slow in the fall/winter. However, as supply pressures ease in the middle of 2025, we expect the Sunbelt Apartment REITs to benefit from strong balance sheets, markets with above average job growth, and a growing affordability gap between apartments and single-family homes. Additionally, we find the valuations of these quality companies compared to private and public peers to be compelling and to offer an attractive margin of safety to investors.

Net Lease

We had positive meetings with five Triple Net management teams, despite interest rate volatility impacting deal-making and earnings growth. Realty Income increased its deal acquisition guidance for 2024 from USD 2bn to USD 3bn, though lower than the USD 8bn in 2023. Realty Income’s CEO, Sumit Roy, remains upbeat about Europe because the region offers higher spreads due to lower interest rates and less lending competition, with the ECB maintaining lower rates compared to the Fed. The average dividend yield for the triple net REITs we met is 7.6%, or 6.1% excluding Global Net Lease (GNL), which boasts a dividend yield of approximately 16% with a coverage ratio of around 85%, considered safe by the CEO.

We spent time with Four Corners' board of directors, gaining insight into their compensation practices to improve our proxy voting and ESG capabilities. CEO compensation is an important part of our investment philosophy and process, and we believe it provides hints about a board's independence.

Retail

Our discussions with Brixmor (BRX) and Tanger (SKT) were encouraging. BRX emphasized the resilience of the open-air Shopping Center (SC) model, noting its competitive foot traffic compared to malls. SCs also offer better e-commerce pickup options with ample parking and incorporate popular fitness concepts, driving increased visitor numbers. While BRX mentioned a significant 1% reduction (through demolition) in obsolete SC supply, we believe this figure may be slightly overstated, though we recognize the positive impact of removing excess supply on sector rents.

SKT highlighted the limited development of outlet projects in recent years, supporting its business model. Despite potential challenges such as the announcement of potential store closures by Stop & Shop due to high prices, consumer demand remains robust with low unemployment. Both BRX and SKT offer attractive total returns, with dividends plus growth at 10% and 16%, respectively. We anticipate a moderation in SKT's yield as management redirects capital towards growth initiatives, providing shareholders with enhanced returns.

Gaming

During a property tour with VICI Properties (VICI), we explored one of their experiential/non-gaming assets, Chelsea Piers in Manhattan. This expansive family entertainment complex boasts ice hockey rinks, TV studios, a golf driving range, and an upscale bowling alley operated by VICI's partner, Bowlero. Despite a growing messaging emphasis by VICI on experiential diversification, over 95% of VICI's revenues still originate from triple net gaming assets, many of which are iconic properties along the Las Vegas Strip. We anticipate that the gaming industry, particularly irreplaceable assets on the Strip, will grow in desirability and value as the area further evolves into a premier destination for sports and entertainment. This transformation is evident through recent developments such as hosting a Formula 1 race, welcoming an NFL team, and introducing immersive entertainment experiences like the new Sphere concert venue.

Asset Tour Pictures

National Storage (NSA) and Welltower (WELL) Tours in Austin, TX – 30 May 2024

|  |

Source: B&I Capital US Inc.

Independence Realty Trust (IRT) Property Tours, Austin – 30 May 2024

|  |

Veris Residential (VRE) Apartment Tours in Port Imperial, NJ – 3 June 2024

|  |

Source: Howard Hughes Holdings

Vici Properties (VICI) Chelsea Piers and Bowlero Property Tours, Manhattan – 3 June 2024

|  |

Source: B&I Capital US Inc.

Download the PDF version of the report here