1. Q3 2024 Earnings – Fundamental Strength

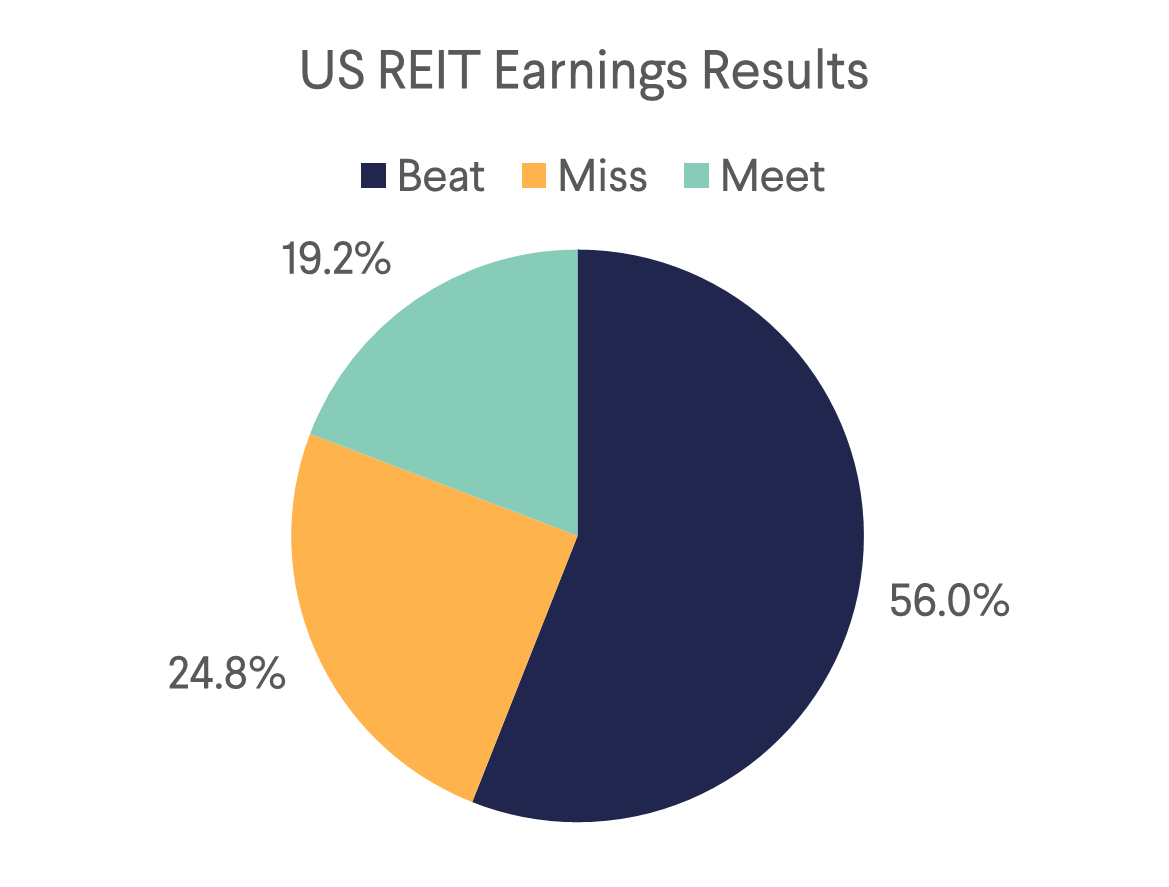

We provide a timely update on US REIT earnings, with 91% of the US REIT market having reported Q3 earnings as of this writing. Overall, REITs saw 4.0% growth in core Funds from Operations (FFO), with 56% of REITs beating estimates, supported by sustained rental and occupancy growth. Despite this, REITs experienced a one-day move of -95bps after reporting, following a run up of 20.9% in the previous six months vs. 13.7% for the SPX over the same period.

Data Centers and Healthcare were the strongest sectors during Q3 earnings, driven by secular demand trends (GenAI for DCs and rebound from covid and aging population for Healthcare) coupled with supply limitations. The Retail and Apartment sectors also saw positive reactions to their quarterly reports. We believe Sunbelt apartments are rapidly reaching an inflection point from decelerating to accelerating rental and earnings growth. Sunbelt markets have seen the largest influx of apartment supply in 40 years. However, supply pressure likely peaked in Q3 and is expected to fall roughly 20% next year before truly plunging in 2026 while absorption and demand remain robust.

Sectors that struggled during the quarter include Industrial, Self-Storage and Single-Family Rental (SFR). Home buying activity is a major catalyst for storage demand (think moving homes and storing goods), which has suffered because of high mortgage rates and home buying at a multi-decade low. Conversely, SFR REITs, which benefit from high mortgage rates and low home affordability, have started to show a deceleration in rents and occupancy. If mortgage rates fall in 2025 as they did throughout the summer, home buying activity will revert to normal levels and result in SFR REITs seeing decreased demand, while the Storage REITs will see higher demand.

2. Positive Trends in Capital Markets Activity

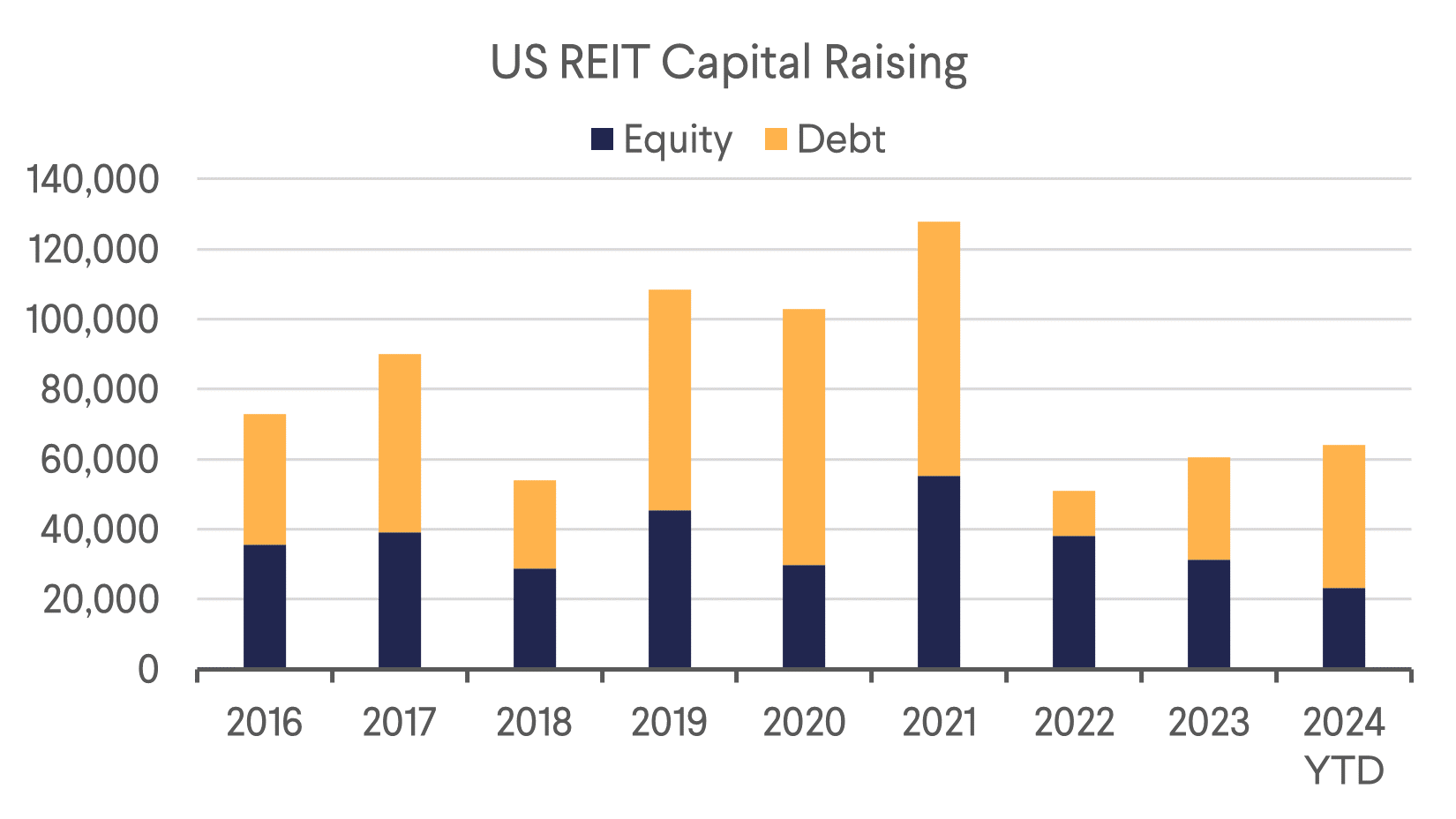

US REITs had raised USD 65bn by September 2024, already surpassing the total for both 2022 and 2023. 63% of the capital raised was debt, as REITs took advantage of their solid balance sheets and more stable interest rates compared to the previous two years. This capital raising is supportive of future growth and will look smart if interest rates back up.

Real Estate transaction activity is showing signs of life moving forward. For instance, during earnings season, Blackstone announced they were buying grocery anchored REIT ROIC, marking their third acquisition of a publicly-listed REIT in 2024 (Tricon Residential and AIR Communities the others).

3. Selected Property Sector Insights

3.1 Retail (Shopping Centers and Malls)

The Shopping Center Sector remains resilient, highlighted by Kimco raising guidance due to record occupancy and pricing power. Supply growth is expected to stay flat from 2024-2028 (versus 1% from 1995-2023), given that retail rents in top markets would need to rise by 65% to justify new development at today's costs of USD 450 per sf. Simon Properties, the mall giant, reported solid domestic NOI growth of 5.4% year-over-year, up from 5.2% in Q2. During the conference call, management discussed higher leasing volumes, occupancy gains, and broad-based demand for its space. Additionally, Simon raised its Q3 dividend to USD 2.10, an increase of 10.5% year-over-year, bringing it back to its pandemic high from March 2020, 19 quarters ago. Overall, projected dividend growth for retail is 4.0% over the next two calendar years, slightly above most sectors except Tech REITs and Industrials.

3.2 Office

Results from Office REITs were bifurcated, with leasing momentum a key theme. Companies who posted strong leasing in Q1 and Q2 continued to deliver in Q3, while the few names that struggled in Q1 and Q2 continued to struggle on the leasing front. The majority of Office REITs, holding exceptionally high-quality portfolios run by strong management teams, have outperformed the US REIT Index handily this year. Sunbelt-focused Highwoods Properties, which saw the highest net effective rents in the company’s 30-year history this quarter, has delivered a total shareholder return of over 55% YTD as of this writing. At the other end of the spectrum, their peer Brandywine Realty Trust sold off 13.6% on the day of their earnings release, as the market reacted to weak leasing, declining occupancy, and a reduction of full-year guidance.

3.3 Data Centers

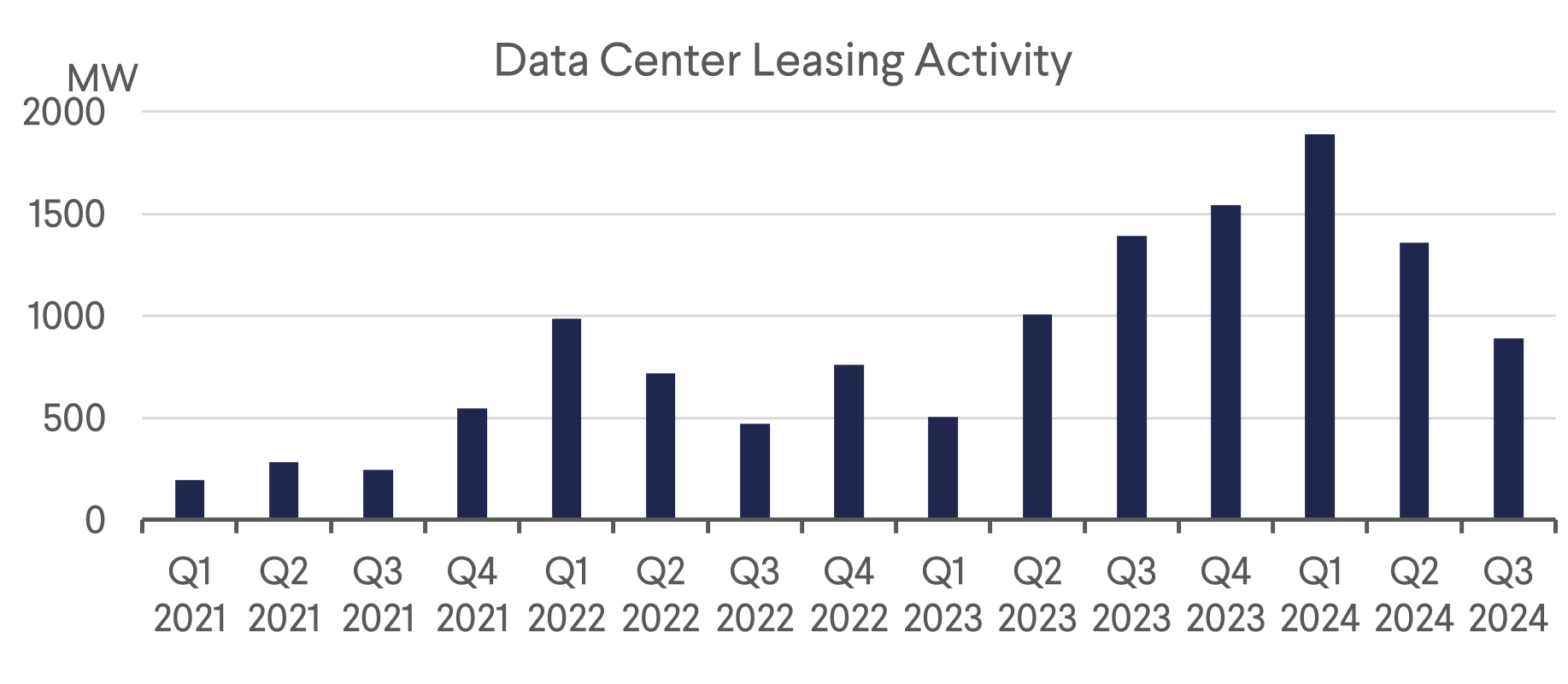

Data Centers, currently one of the hottest property sectors, saw 900 megawatts (MW) of capacity leased in Q3 across tier-one markets, c. 80% of which was in the US. Accordingly, each public Data Center REIT achieved record quarterly bookings for a second time this year, following records set in Q1 by DLR and Q2 by EQIX. Demand from hyperscalers is apparently insatiable, and the public REITs continue to be their preferred partners. Supply continues to be limited by access to power, which will support future growth in rental rates.

3.4 Healthcare

Senior Housing (SHOP) and Skilled Nursing (SNF) REITs had another great quarter with multiple earnings beats and guidance raises. Senior Housing REIT Welltower expects NOI to increase 23% in 2024 and has seen occupancy improve by 300bps this year. We believe occupancy can continue to grow at least another 600bps. Valuations of many Healthcare REITs are at historically high levels, but with occupancy trending up, and high operating leverage, we see continued upside to earnings growth. We are closely monitoring the situation to determine when the undersupply dynamic shifts, but with elevated construction, labor, and debt costs, there continues to be virtually no new supply in the SHOP and SNF being built to capture growing demand.

4. Conclusion

Overall, Q3 was a continuation of a decent year for most REITs, especially the type we invest in with strong governance, balance sheets, supply/demand fundamentals, and accelerating earnings and dividend growth prospects. Assuming rates do not move materially higher, we are bullish on increasing transactions in real estate markets in 2025 and see signs that REITs are preparing balance sheets to take advantage of this opportunity set. After heading to Las Vegas next week for the NAREIT conference, we look forward to providing another update based on our 33 meetings and property tours with REIT management teams.

Download the PDF version of the article here